If there has been a change in the Number of Renewals to factor into your IFRS 16 calculations since your Agreement commenced, you need to use the IFRS Settings Change Questionnaire to record this change. This process is essential to ensuring that your IFRS 16 reports accurately reflect the real-world state of the Agreement. This article will go through the steps required to ensure the change is recorded correctly.

Please note: This process does not include changing any details in the Initial IFRS 16 Questionnaire. Those details should not be altered, as they inform the opening balances of your Agreement.

Video Tutorial: Changing your Expected Number of Renewals

Check out this video guide on how to change the number of Renewals factored into your IFRS 16 Calculations after Commencement, or continue reading ahead.

Before you Update the Expected Number of Renewals

To guarantee accurate report generation, exercising renewals/option dates or recording term extensions for IFRS 16 calculations must be processed before the current term of the Agreement expires. If these updates are made after the expiry date or the current term, the system will treat the Agreement as expired, which means, from a technical perspective, it cannot be extended.

Changes to Expected Renewals/Extensions made after the Expiry Date can result in several different reporting errors, such as:

Journal Reversals of Right of Use Assets at incorrect dates: This means that the reversal entries may be processed mid-agreement instead of on the actual Expiry Date.

Missing or incomplete adjustments: Changes to rent amounts or interest/discount rates may not be fully captured within the system, which would result in missing Journals and inconsistencies throughout your records.

Reports not closing properly: Disclosure or balance reports may continue to show outstanding balances for Right of Use Assets or Lease Liabilities, even after the agreement has expired.

We have preventative workflows in place to avoid these errors, and have provided step-by-step instructions on how to perform these workflows in the section below. Please remember to:

- Always process updates to renewal/option date decisions and term extensions before the Agreement's Expiry date.

- Record these updates using a Variation event, rather than using the Renewal event. The Renewal event should only indicate the start of a new term, while the decision to renew must be documented in advance of the Expiry date.

How to Update the Expected Number of Renewals

If there is an Event (that is not a Renewal or Expiry) already scheduled to occur in your Agreement on the date you've agreed to update your Expected Number of Renewals, you can use the Settings Change Questionnaire on that scheduled Event to process this change. Jump ahead to Step 6 below for the remaining instructions on how to update your Expected Number of Renewals.

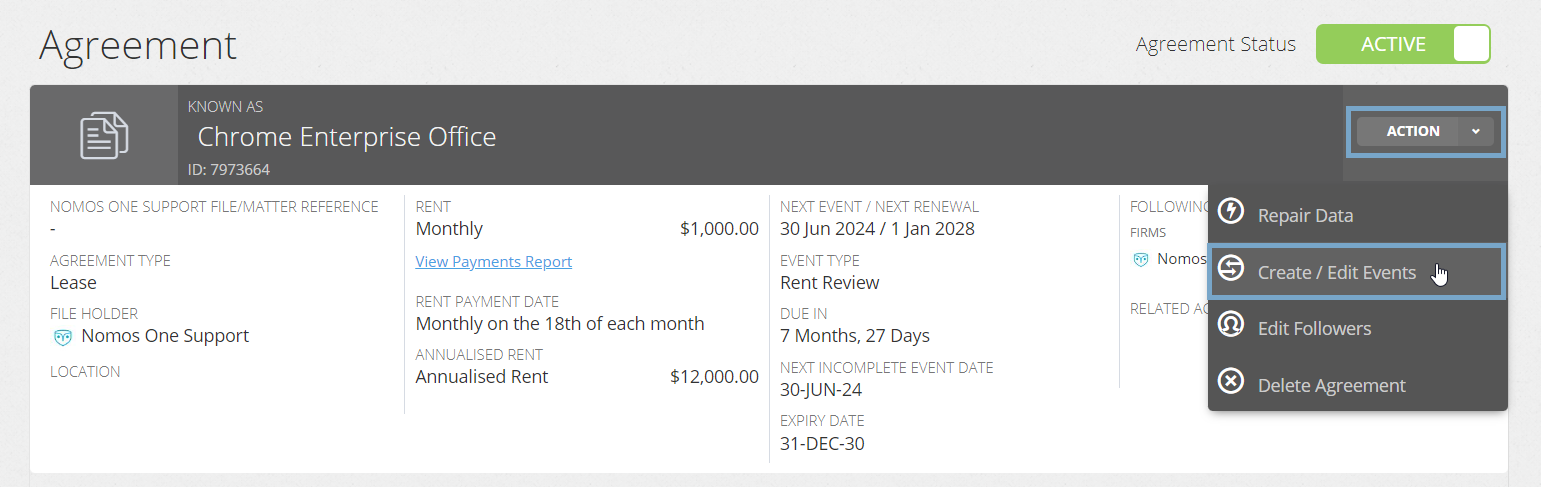

- On your Agreement, click “Action”, then “Create / Edit Events”.

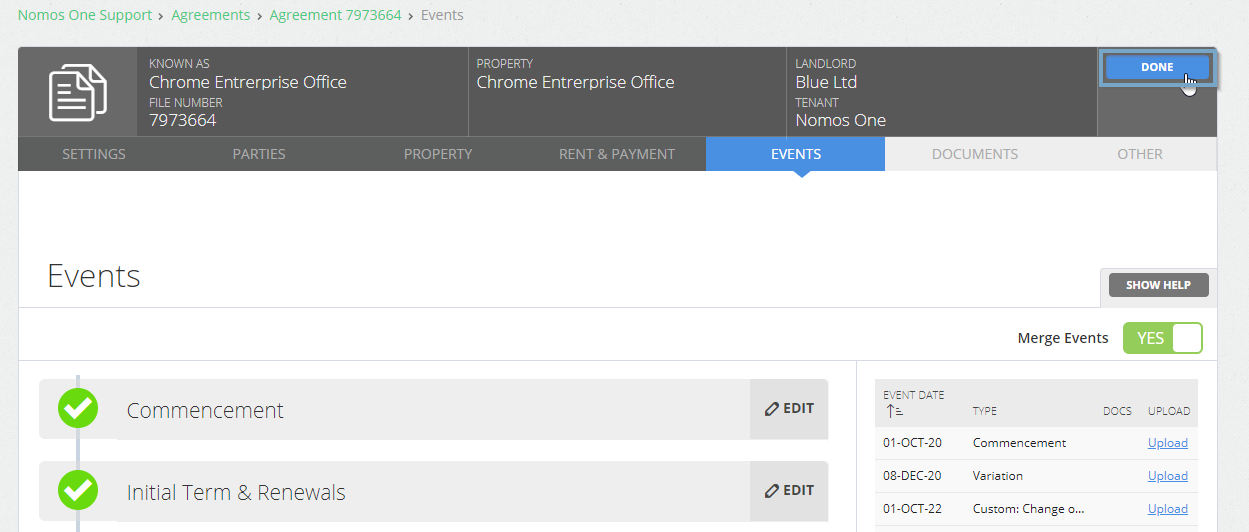

- On the Events page, scroll to the Variation section and click “Edit”. Using the calendar tool or text field, add in a Variation Event for the date you agreed to change the Expected Number of Renewals. This Variation Event must be scheduled at least 1 day before the expiry of your existing term. Remember to click “Add”.

Why does the Variation Event have to be at least 1 day before the expiry of the existing term? In Nomos One, an update to the Expected Renewals must be processed at least one (1) day before the expiry of the existing term, to ensure reporting is correct. Otherwise, the system reads the Agreement as having expired, and given that you cannot logically renew an Agreement that has expired, the IFRS 16 reports do not reflect the change in Expected Renewals correctly.

- Once you've added in your Variation and renewal/extension, click “Done” at the top of the page to return to the Agreement Timeline.

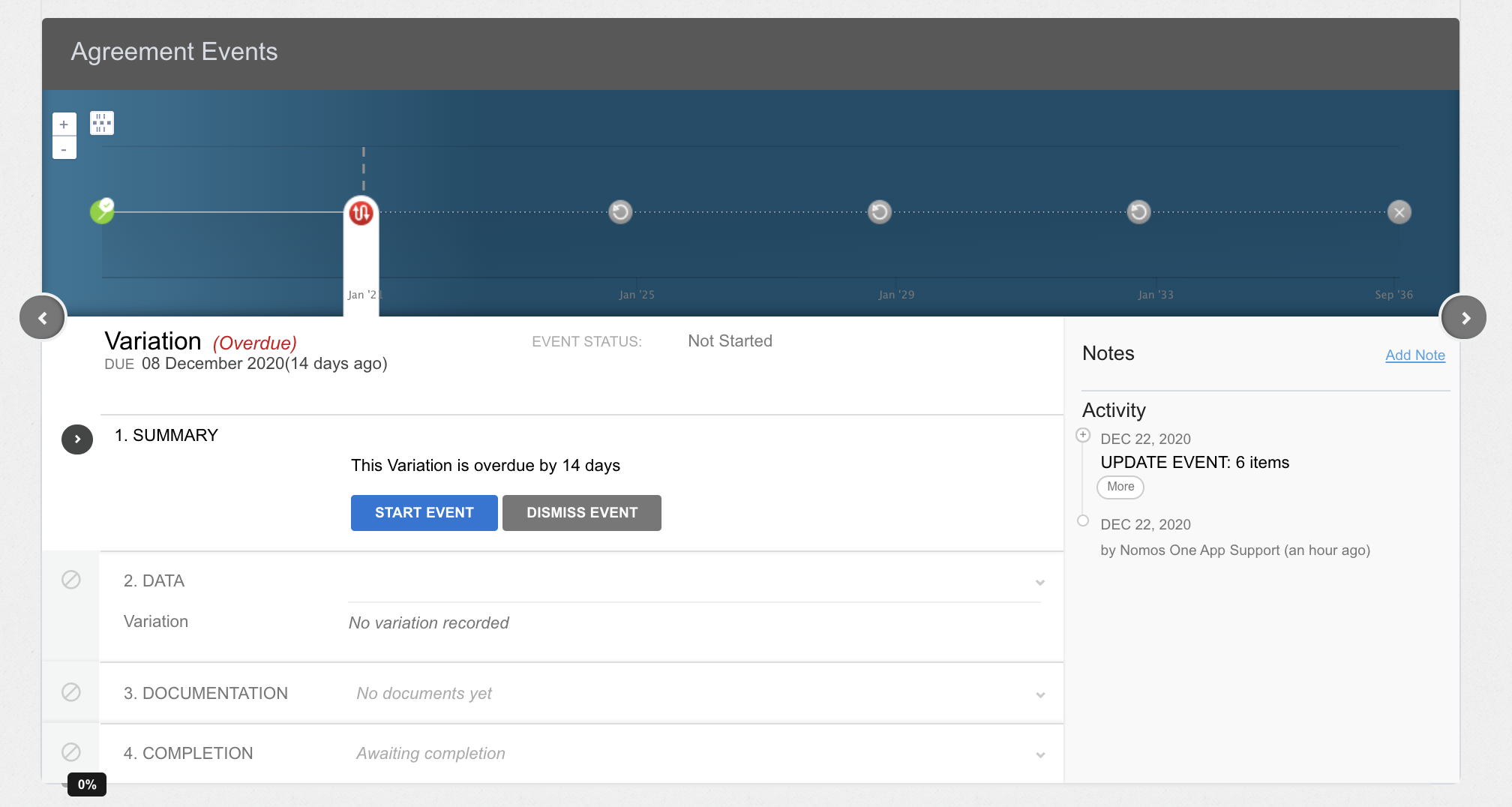

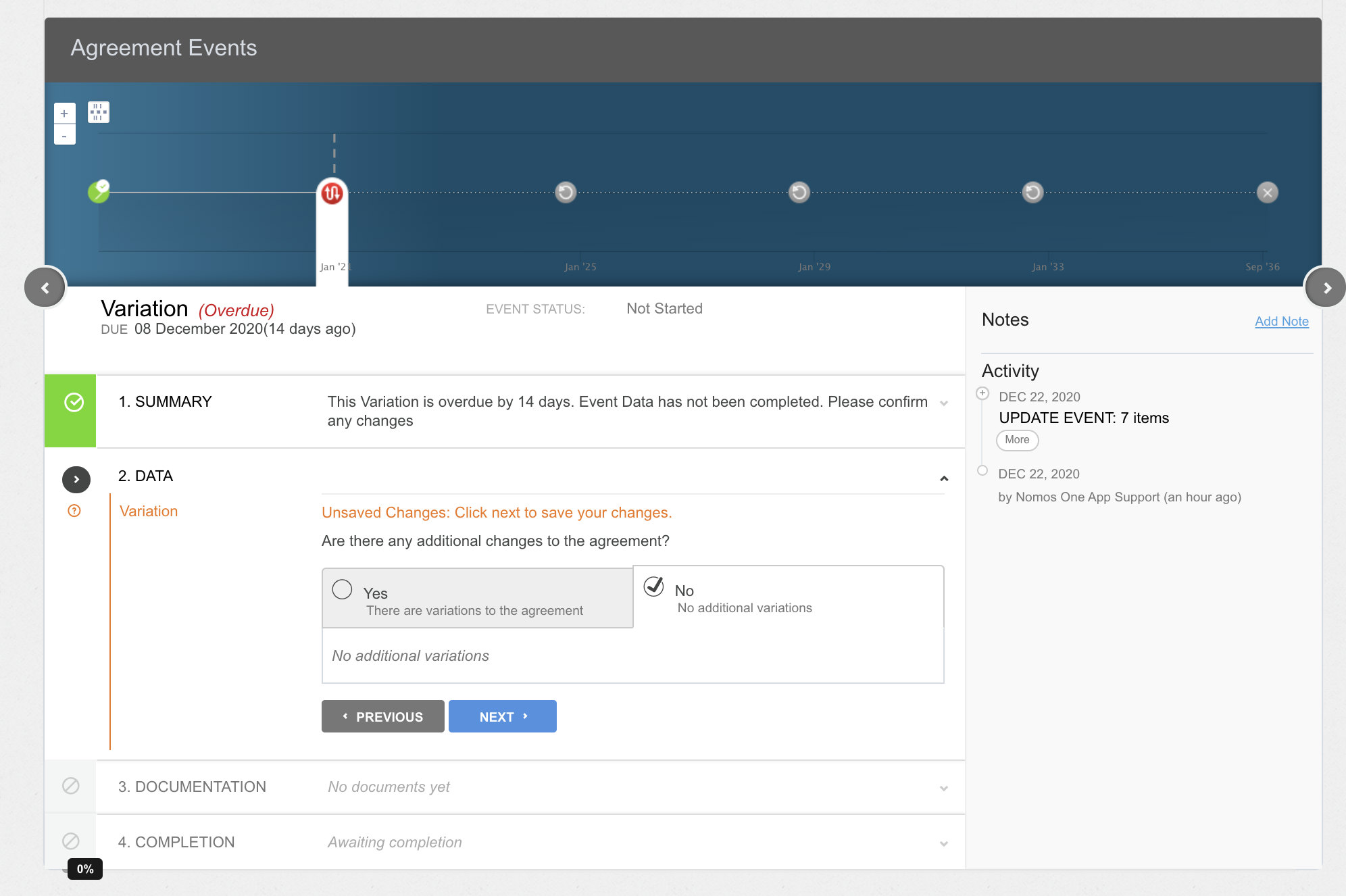

- On the Agreement Timeline, click on the Variation Event icon and then click “Start Event”.

As the IFRS 16 Settings Change Questionnaire is always tied to an Event, you won't be able to add or edit the IFRS 16 Settings Change Questionnaire on an Event that is within a locked period. You'll need to ask a user with the Administrator permission in your Organisation to edit the Lock Date. Check out this article for more information.

- At Step 2, if there are any changes to the contractual data of your Agreement which take effect from the Variation date, click “Yes” and record these changes through the usual Variation workflow. If there are no other changes to your Agreement effective from the Variation date, you can simply click “No”, then click “Next” to continue.

- Upload any supporting documentation, or select “No Documentation” and click “Next”.

- Click “Complete” to finish the event completion process.

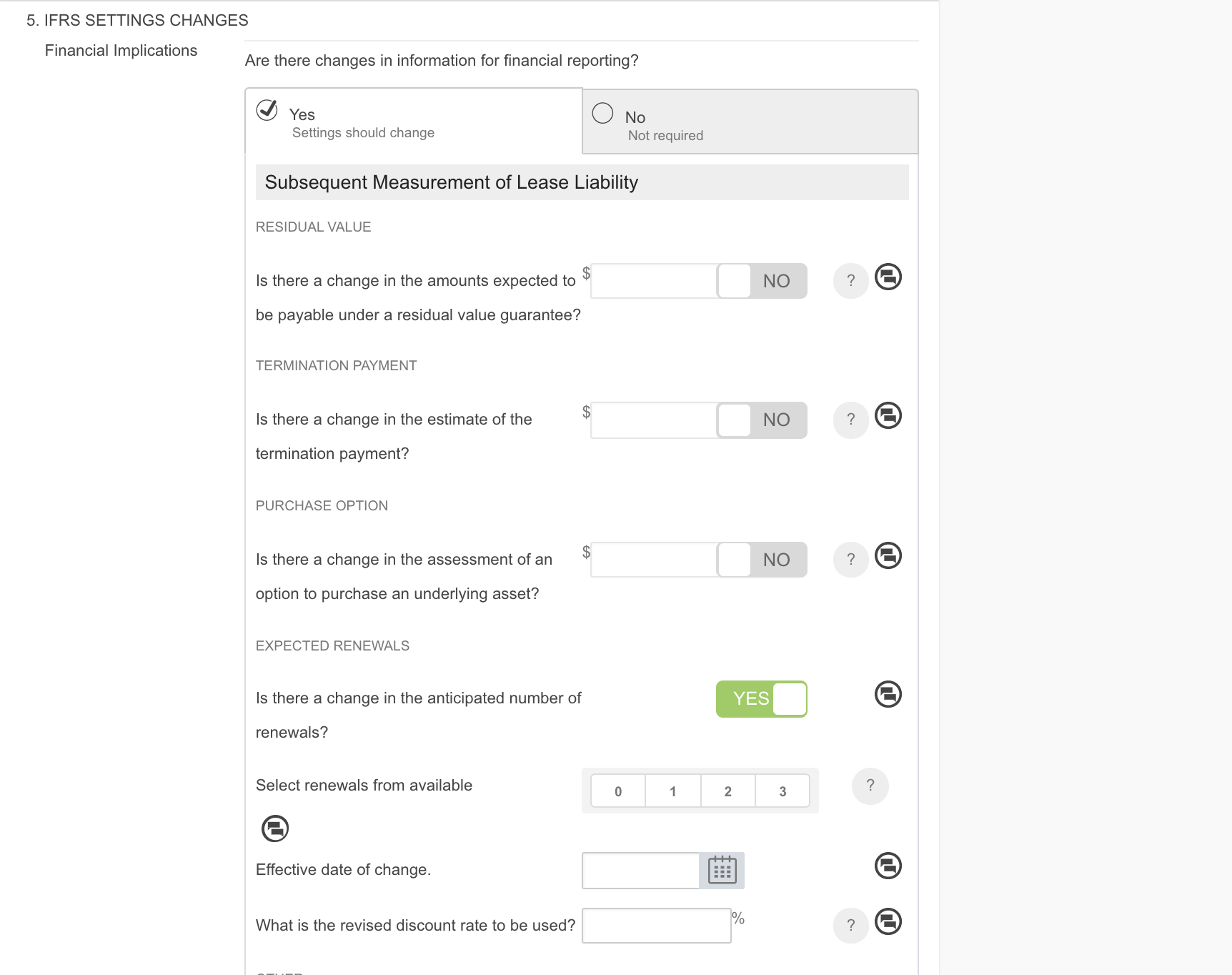

- On the completed Variation Event, you'll need to update the IFRS 16 Settings Change Questionnaire to reflect the change in Expected Renewals in IFRS 16 reporting. To do this, select the option “Yes” on the IFRS Settings Change questionnaire.

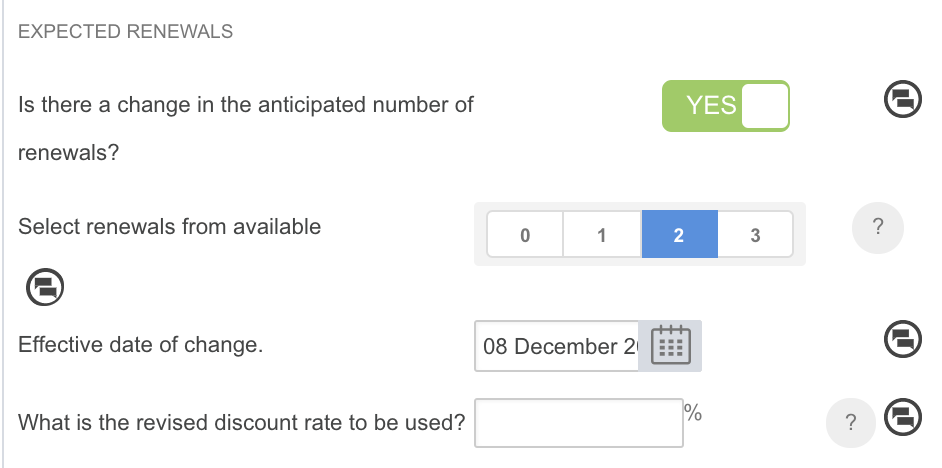

- Scroll to the Expected Renewals section, and toggle “Is there a change in the anticipated number of renewals?” to read Yes. You'll then need to:

- Include the future term in your reporting by selecting the number which corresponds to the future term. Remember that the numbers directly reflect the number of renewal events.

- Use the calendar tool to record the “Effective date of change”. This should match the date of the Variation event.

- If the discount/interest rate has changed, effective from the same date, you can record a new rate here.

- Scroll to the bottom of the Settings Change Questionnaire and click “Save”.

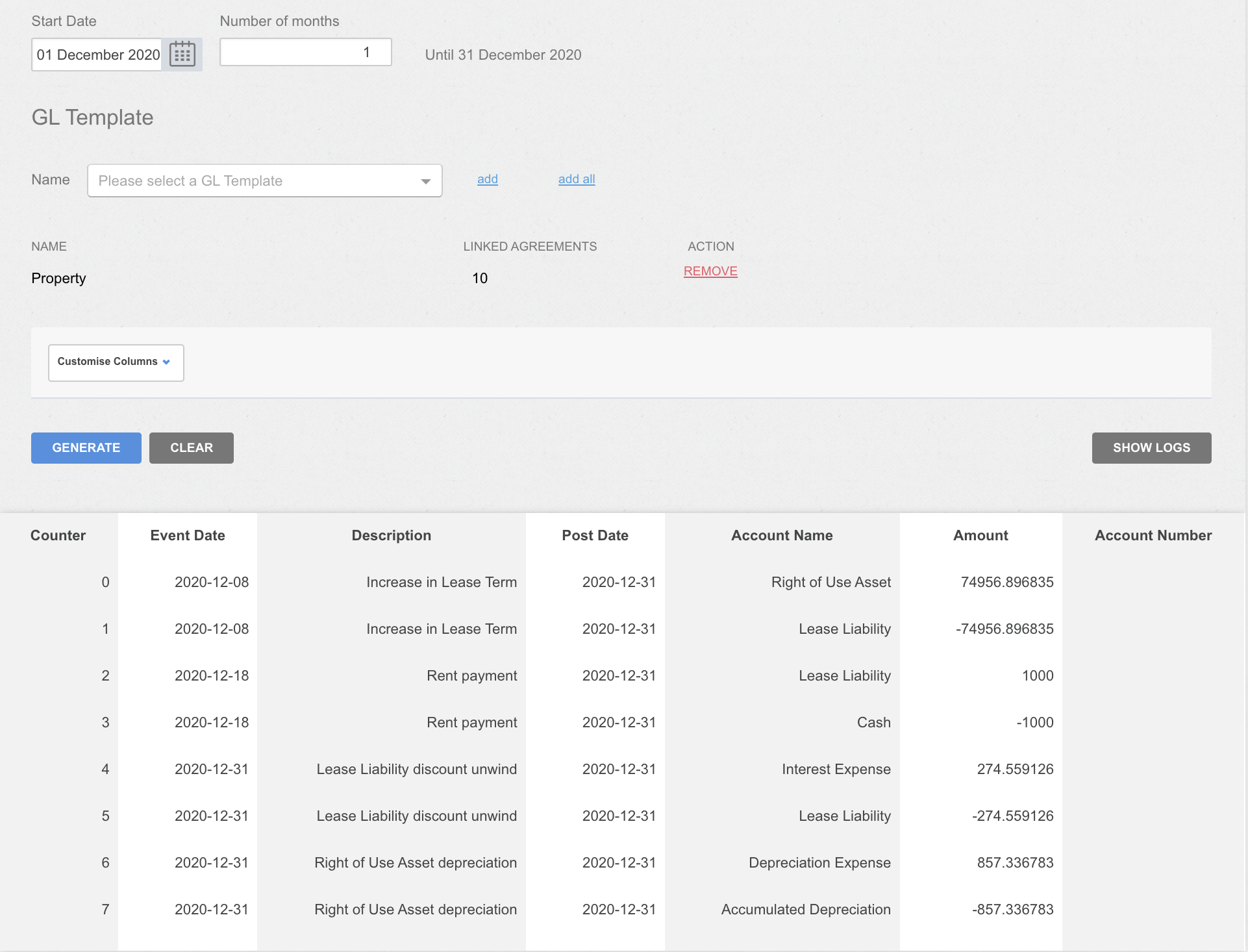

How to Validate a Change to your Expected Number of Renewals

To validate that the to your Expected Number of Renewals has been processed correctly, you can run the Journal Report across the Variation event date. You'll see a remeasurement for either the increase or decrease in lease term on this date.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.