In this tutorial we're showing you how you can review new Agreements that have been added to your Organisation. Running a Custom Agreement Report is a helpful exercise as part of your routine checking to see if all of your Agreements are up to date, but it's even more useful when its coming up to your business's financial year end, so you can determine what Agreements may not have been accounted for before.

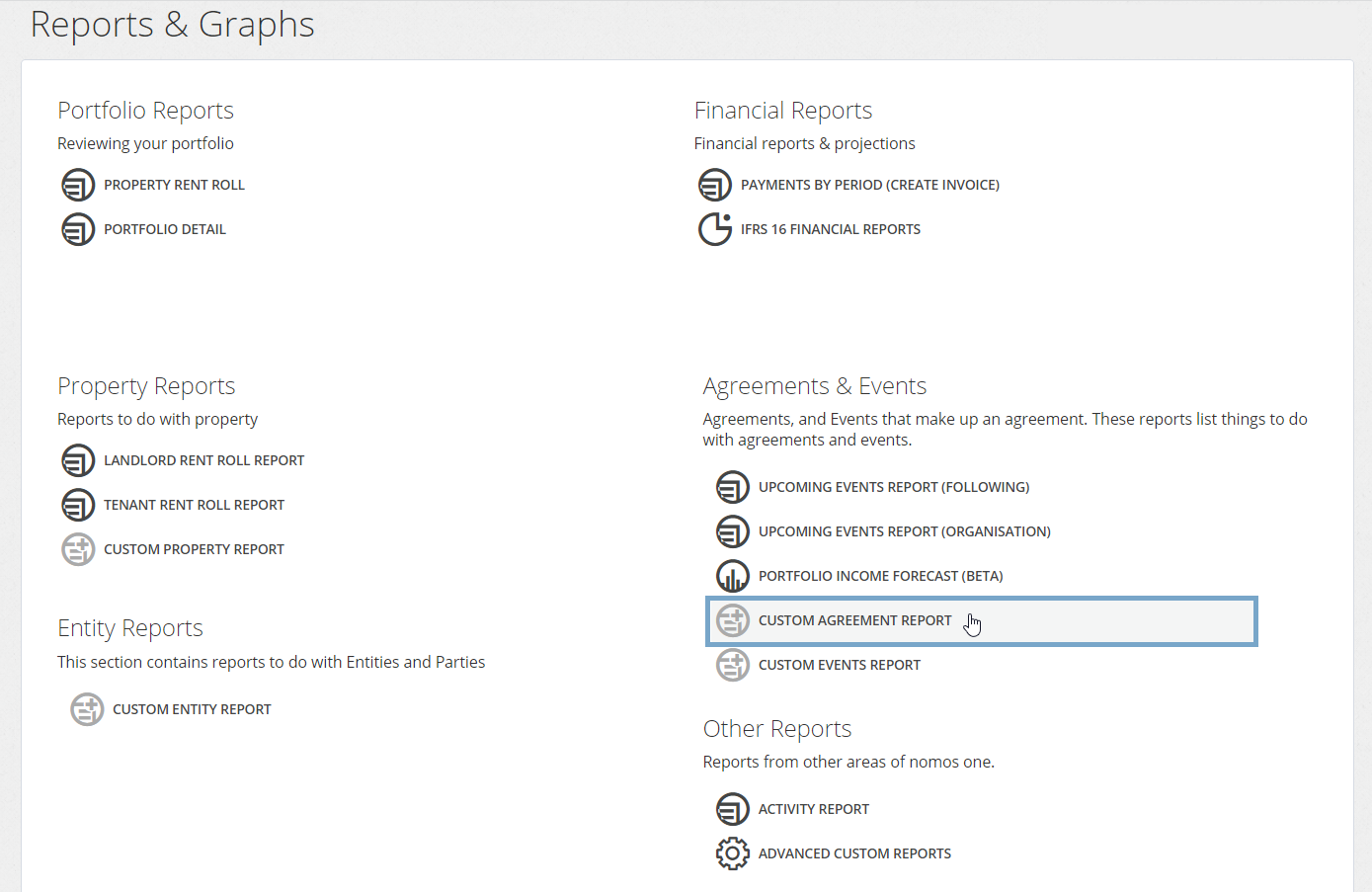

How to access the Custom Agreement Report

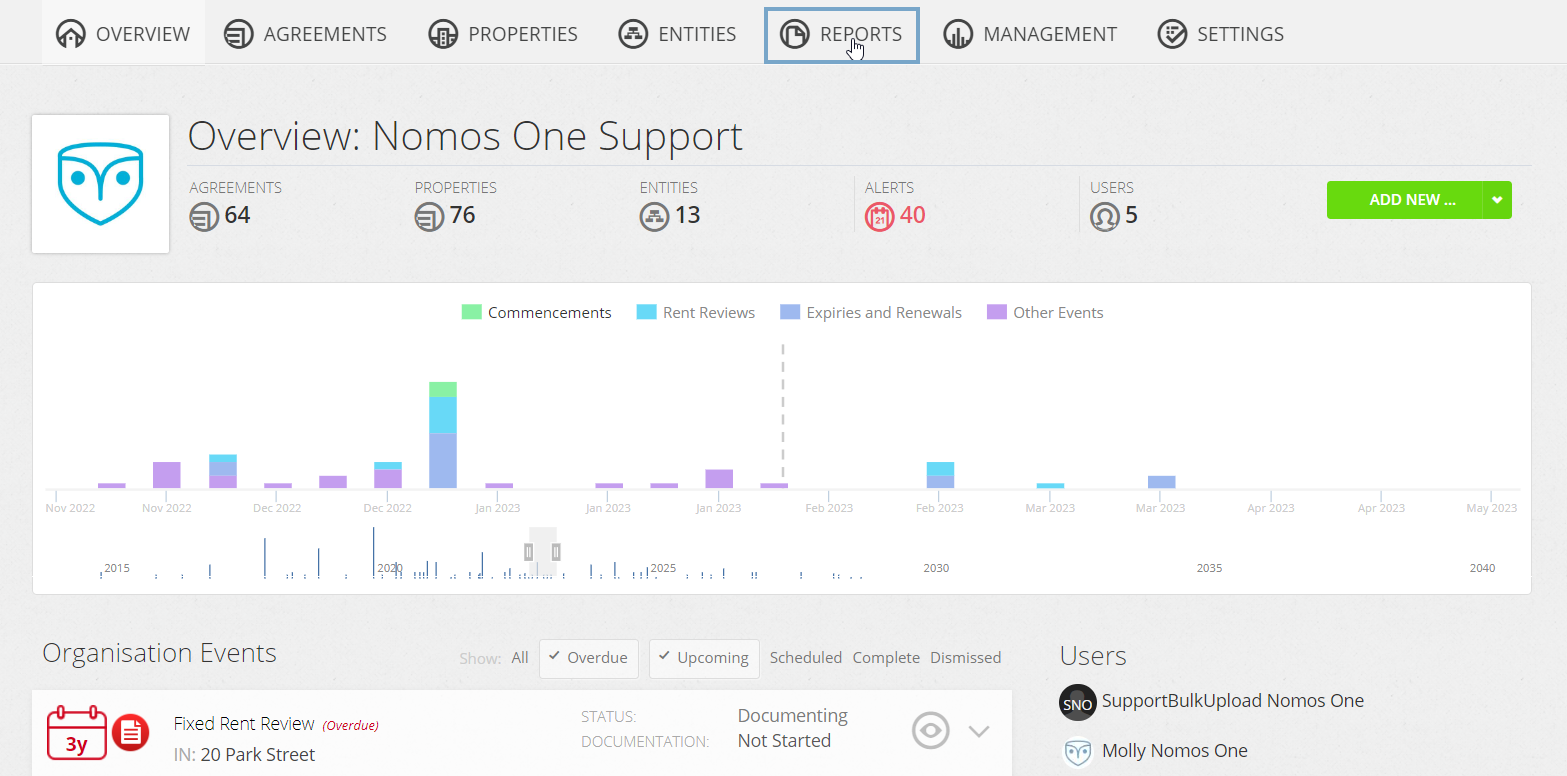

- Navigate to the Reports page

- Under Agreements & Events, click Custom Agreement Report

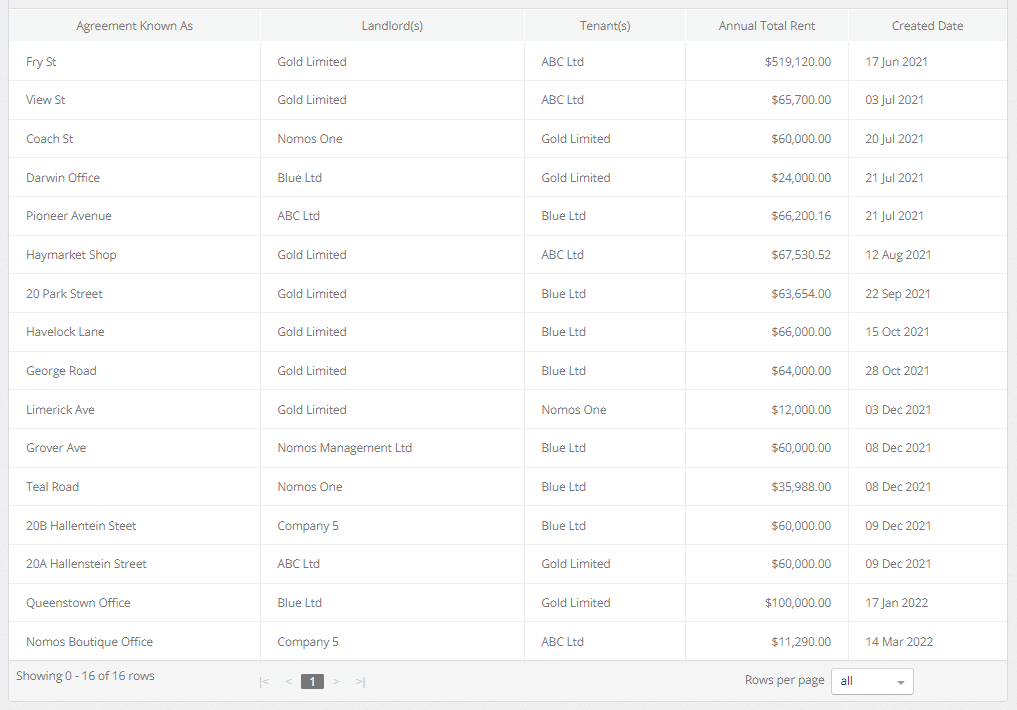

The default setup of this report shows you basic Agreement information. You can change this setup by using the Filters, Columns and Group tools.

Customising the Report to see all Agreements added within a time frame

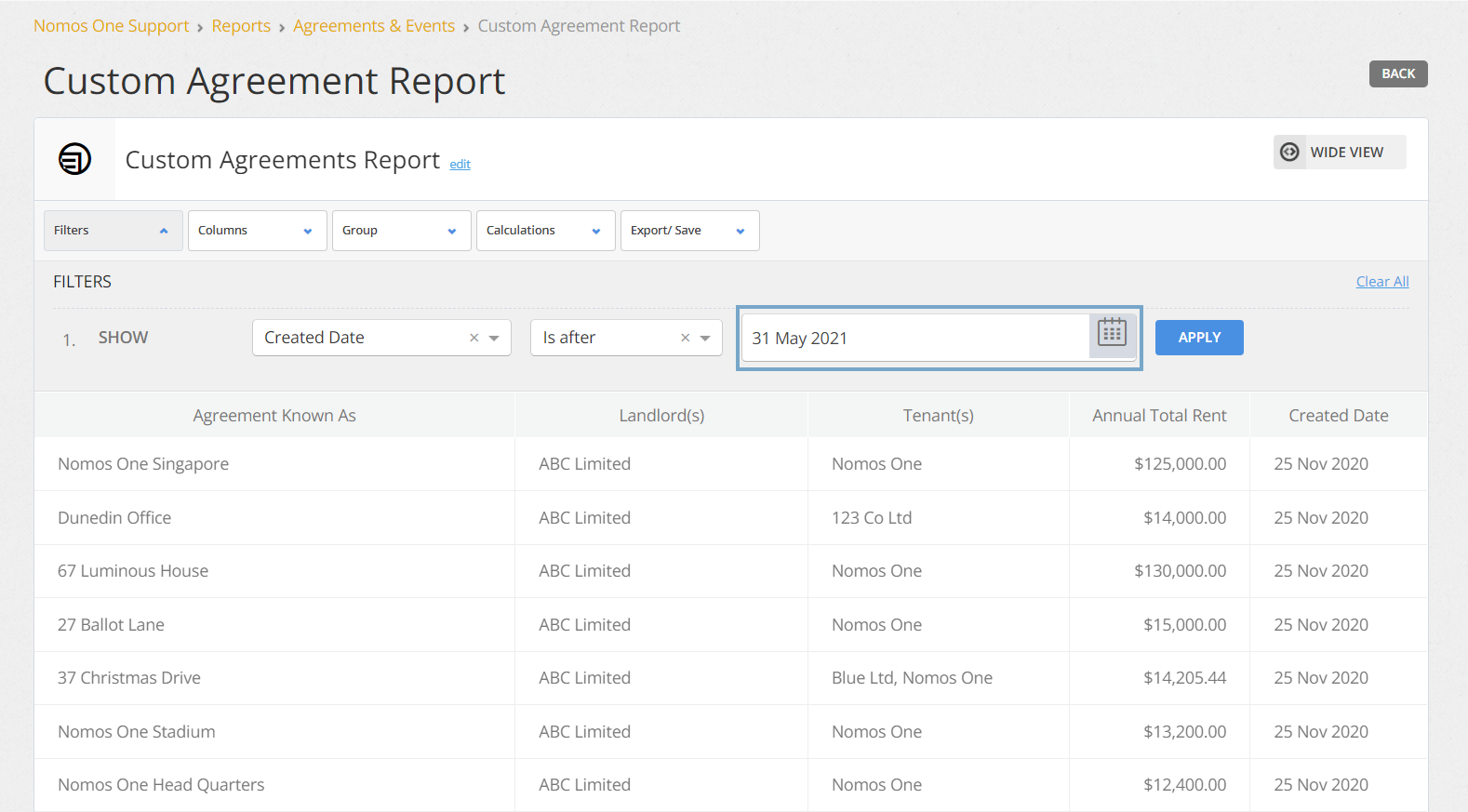

- Click on the Filters button

- Click on the Select column to filter drop down bar and select 'Created Date'

- Click on the Select operator drop down bar and select 'Is after'

- In the calendar field, type or select using the calendar tool the date before the period you're reporting on, E.g. if you are reporting on the period 1 June 2021 to 31 May 2022, enter 31 May 2021.

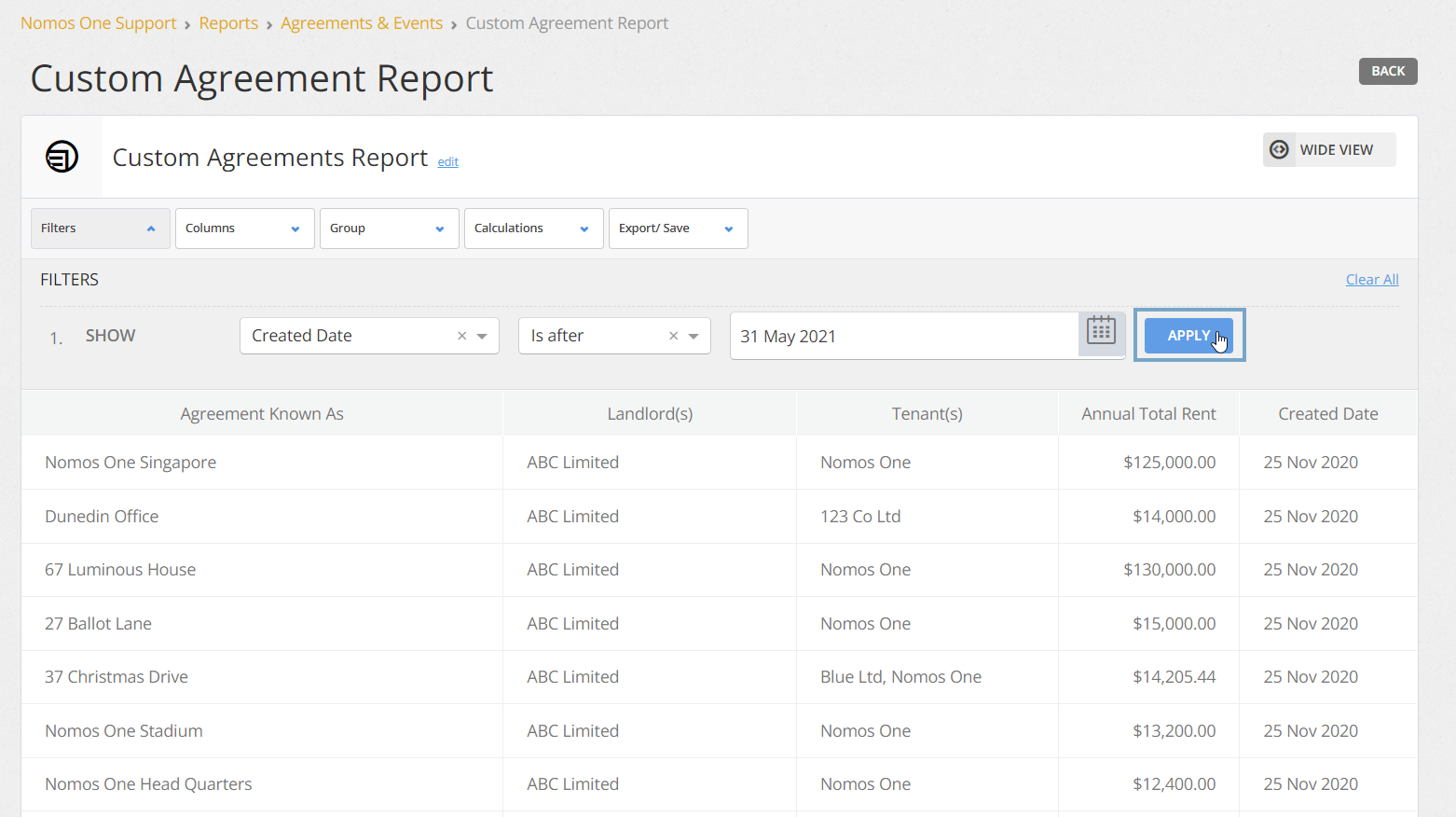

- Click the Apply button to add this Filter to your report

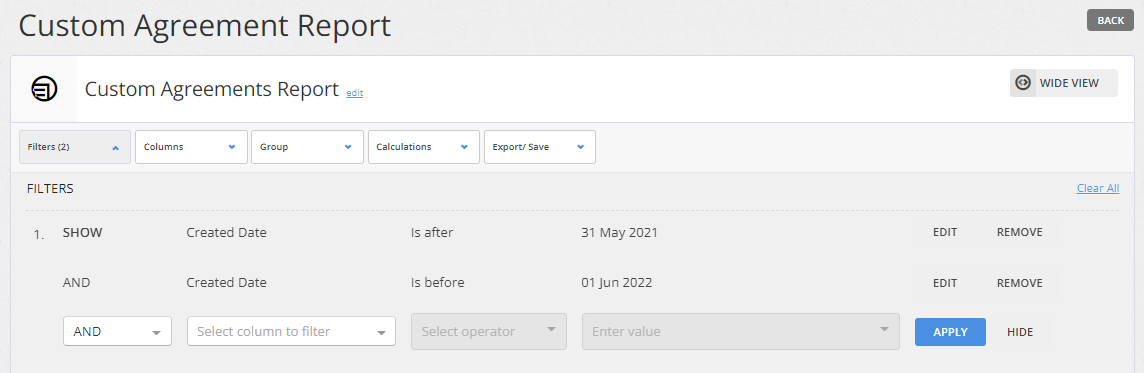

- Repeat steps 2 - 5 with the following changes:

- At step 3 select 'Is before' and;

- At step 4 enter the date after the reporting period ends

Your report should now show all Agreements created in Nomos One within the time period you've selected.

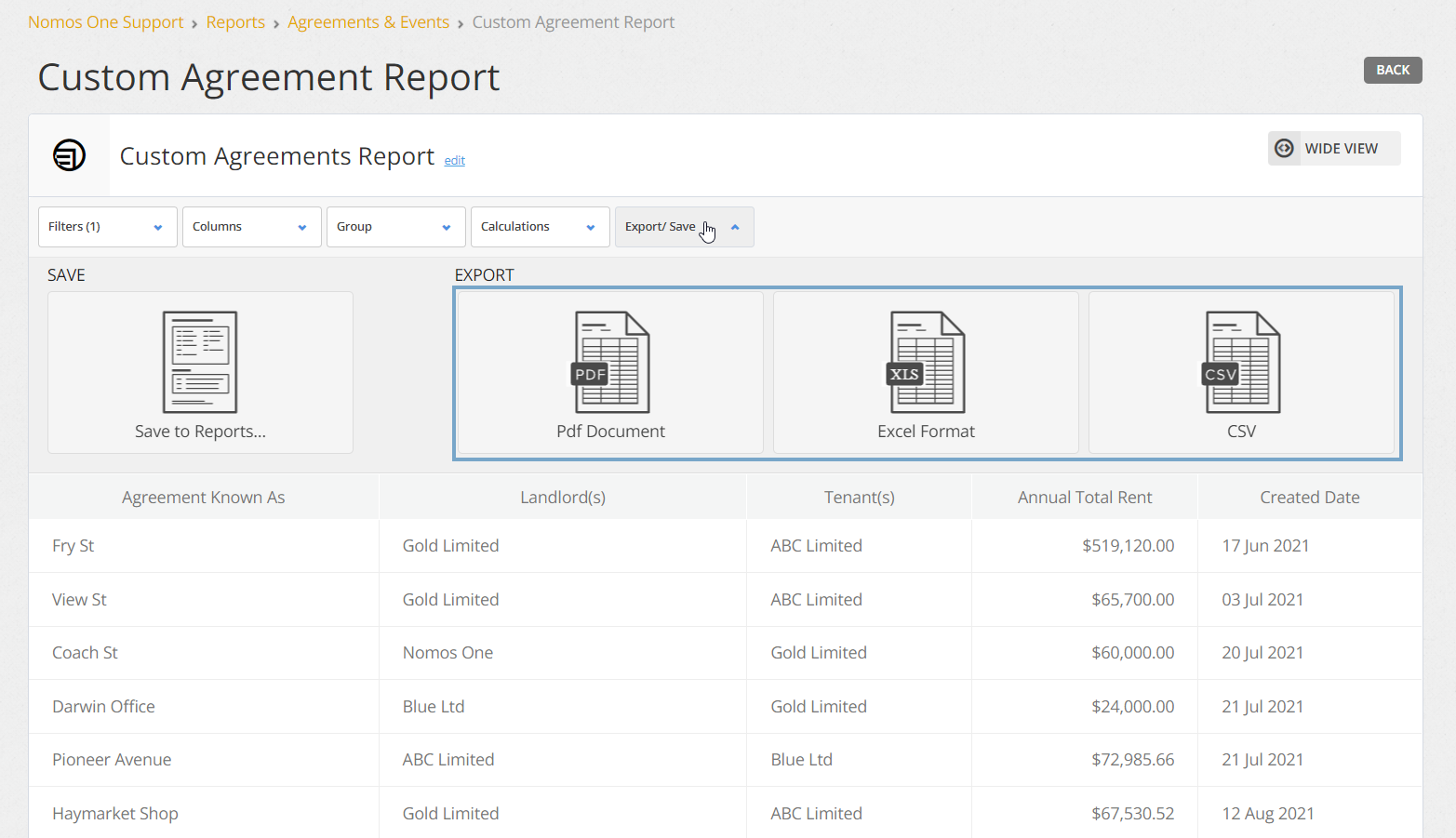

- Click on Export/Save and select Pdf Document or Excel Format to download your report

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.