In this article we're answering some of the most common questions about IFRS 16 set up and reporting in Nomos One. For further guidance we recommend checking out our IFRS 16 category as these dive deep into the specifics!

Applying IFRS 16 Settings and IFRS 16 Settings Changes

Q: What's the difference between the initial IFRS 16 Questionnaire and the IFRS 16 Settings Changes?

The Initial IFRS 16 Questionnaire records your accounting assumptions as at the beginning of your Agreement. These are the assumptions that will apply for the life of the Agreement unless you update them using the IFRS Settings Change Questionnaire.

Updating your assumptions through the IFRS Settings Change Questionnaire will:

- Preserve your initial assumptions up until the Event date you complete the Settings Change Questionnaire on,

- Show you any required remeasurements on the Event date you completed the Settings Change Questionnaire on, and

- Only apply your new assumptions prospectively!

If you try and update your assumptions after commencement by editing the Initial Questionnaire, this change won't time stamp and will result in your new assumptions applying from commencement, thus affecting your opening balance.

Q: The Modified Transition methods: Which method should I use for leases that commence after transition?

The Modified Retrospective method should be used for all Agreements that commence after transition. The Simplified method was available as one of two options for Agreements that existed at transition.

With a new lease, there's no chance you're missing any historical data, so there’s no need to apply the Simplified approach!

Check out this article for more information.

Make Good Provisions

Q: Why are there separate sections for Make Good provisions in the IFRS 16 Questionnaire?

Where you enter your Make Good provision depends on the transition method you've selected. Agreements that have had the Simplified approach applied at transition will require the Make Good to be present valued at that date.

Q: Why are Make Good entries not appearing in my Reports?

There are two causes of this issue:

- You've entered the Make Good provision in the wrong section for the transition method you've assigned to the Agreement; or

- You've applied the Simplified method to an Agreement that commenced after your Organisation's transition date

Check out how you can resolve these issues below!

You've entered the Make Good provision in the wrong section for the transition method you've assigned to the Agreement:

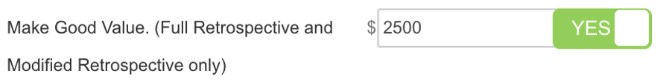

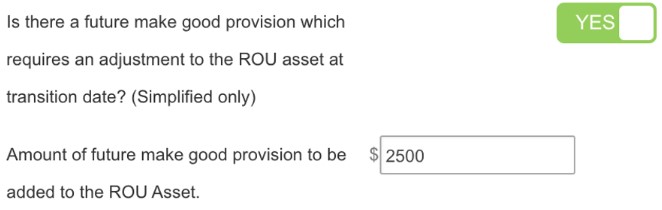

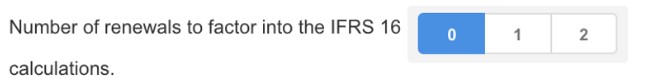

- In the IFRS 16 questionnaire, we have separated out the Make Good provisions due to different treatments within the system’s calculator for different transition methods.

- If you’ve applied either the Full Retrospective or Modified Retrospective approaches to an Agreement, you'll need to enter these provisions in the sections marked “(Full Retrospective or Modified Retrospective only)”

- If you’ve applied the Simplified approach to an Agreement, you'll need to enter the provision in the section marked “(Simplified only)”. You can find this in the Modified Transition section of the questionnaire.

You've applied the Simplified method to an Agreement that commenced after your Organisation's transition date:

- If your Organisation opted to apply Modified Transition Methods to your Agreements, for those that commenced after your Organisation's transition to IFRS 16, check that you have the Modified Retrospective method assigned to it.

- If Simplified is selected, update the method to Modified Retrospective and ensure you've entered the provision in the Make Good section marked "(Full Retrospective or Modified Retrospective only)" on the IFRS 16 Questionnaire to correct this.

Reporting beyond the Initial Term

Q: Why is my Agreement not reporting despite completing the Renewal Event?

Completing the Renewal Event on the Agreement Timeline only updates the Agreement from a lease management perspective. To include a renewal term in your IFRS reporting, you need to ensure you've factored it into your expected number of renewals to be exercised.

How you'll update the expected number of renewals for an Agreement will depend on when it was decided the renewal would be included in your calculations.

If it was known at transition or commencement that the renewal term would be included in calculations:

- If it was known at this time and the agreement is not reporting within the renewal time frame, this will be a data entry error, i.e.: when the user completed the commencement or transition IFRS settings, they incorrectly selected how many terms were expected to be exercised.

- To remedy this, you'll need to update the initial IFRS 16 settings.

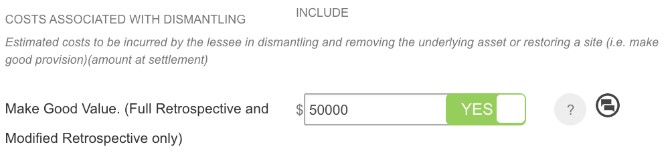

- Click Action > Repair Data and scroll to “Number of renewals to factor into the IFRS 16 calculations."

- Select the number of renewals that you reasonably anticipated to exercise as at transition or commencement of the lease.

- Click Done to save changes to the Agreement.

If it was not known at transition or commencement that the renewal term would be included in calculations, and instead there has been a modification to the original IFRS 16 settings:

- We've got an awesome article that explains how to update your Expected Renewals effective after commencement - check it out here!

IFRS Journal Report Entries

Q: Why do I see a "Reversal of Right of Use Asset entry when my Agreement expires or all expected Renewals come to an end?

Prior to the "Reversal of Right of Use Asset" journal, there is a zero book value of the Right of Use Asset, however there is a gross Right of Use Asset balance and an equal Accumulated Depreciation balance. Due to the fact that upon expiry of the lease, you no longer control the leased asset, it should be removed from both of your general ledger accounts.

This entry credits the Right of Use Asset balance and debits the Accumulated Depreciation balances so that the amounts within these accounts are both zero upon expiry of the lease. This entry is in line with other asset clearing entries upon disposal / no longer owning or controlling the asset.

Q: What does the entry "Remeasurement of Lease Liability" mean?

At Nomos One we use "Remeasurement of Lease Liability" to indicate a variety of changes that cause a remeasurement in your IFRS 16 Reports. The following actions trigger this entry:

- Completion of a scheduled Market and/or CPI Rent Review Events with no Floor added.

- Completion of a scheduled Market and/or CPI Rent Review Events with a Floor added and Rent changed to different value than Floor indicated.

- Completion of a scheduled Fixed Rent Review with Manual amount (i.e. different from the Rent amount projected).

- Rent Holiday/Discount entered.

- Change to Interest Rate.

To work out which action has triggered the entry, navigate to your Agreement Overview and select the Event with the date that matches the date of the entry on your Journal Report. If it's a Rent Review, that'll likely be the cause of the entry.

If there's no other change specified on the Event or IFRS Settings Changes, it'll likely be a Rent Holiday. You can navigate to the Rent & Payment page to check this, but make sure not to update any data while you're at it!

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.