If there’s been an update to the Interest Rate to be applied to your Agreement after it has commenced, you need to record this using the IFRS Settings Change Questionnaire. This guide is tailored to when the only IFRS update you have is a change in Interest Rate. If there are other changes to your IFRS 16 judgements, such as a change in the Change the Expected Number of Renewals, you’ll see an option when you process that change to update your Interest Rate in a separate field.

How to update your Interest Rate

If there's an Event already scheduled to occur in your Agreement on the date you've agreed to update your Interest Rate, you can use the Settings Change Questionnaire on that scheduled Event to process this change. If this applies, jump ahead to Step 8 and follow the instructions from there.

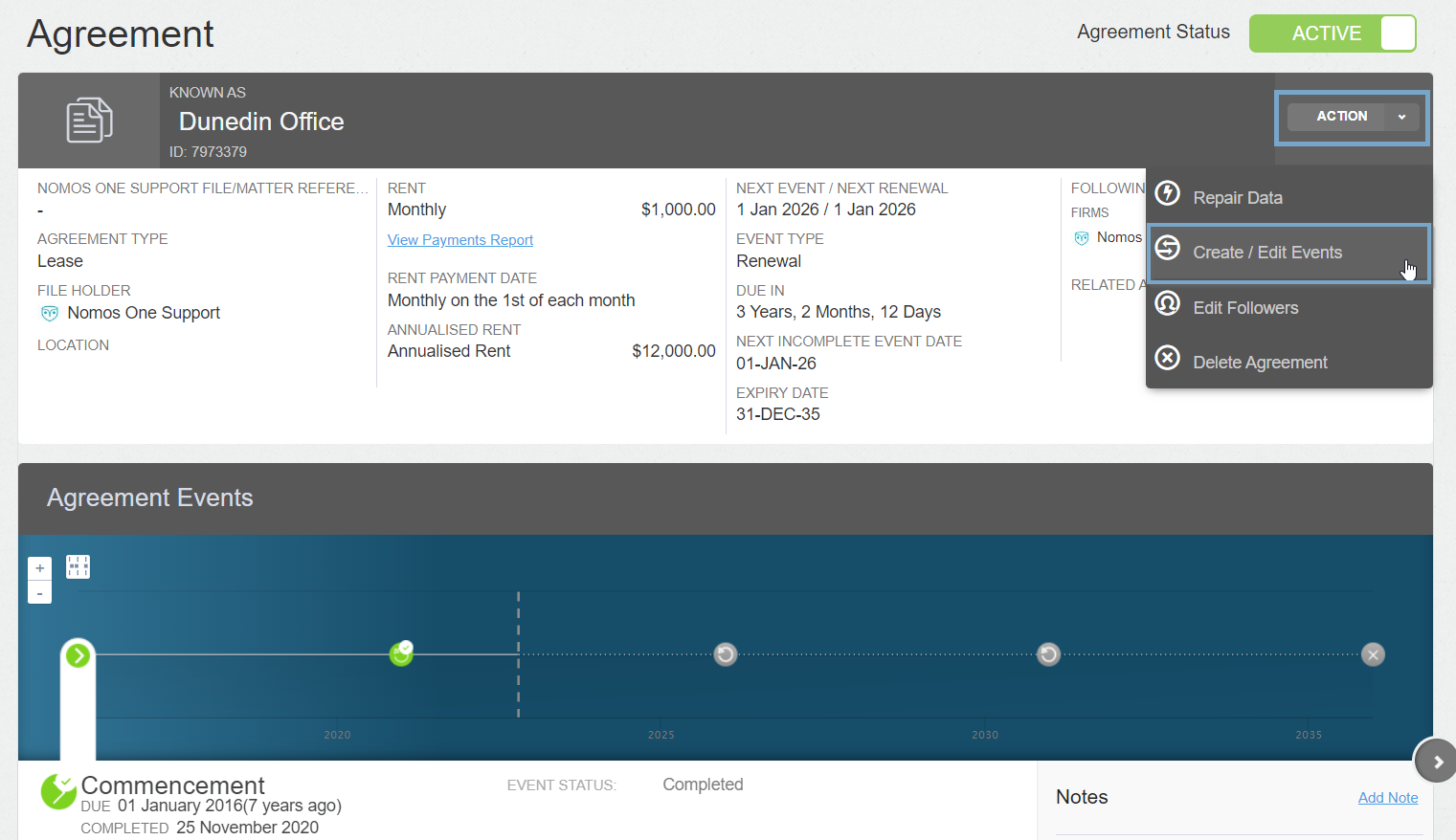

- From the Agreement Timeline, click Action > Create / Edit Events

- On the Events page, Scroll down to the Variation section and click Edit

- Record the Effective Date that you agreed to change the Interest Rate then click Add. Press the Done to return to the Agreement Timeline

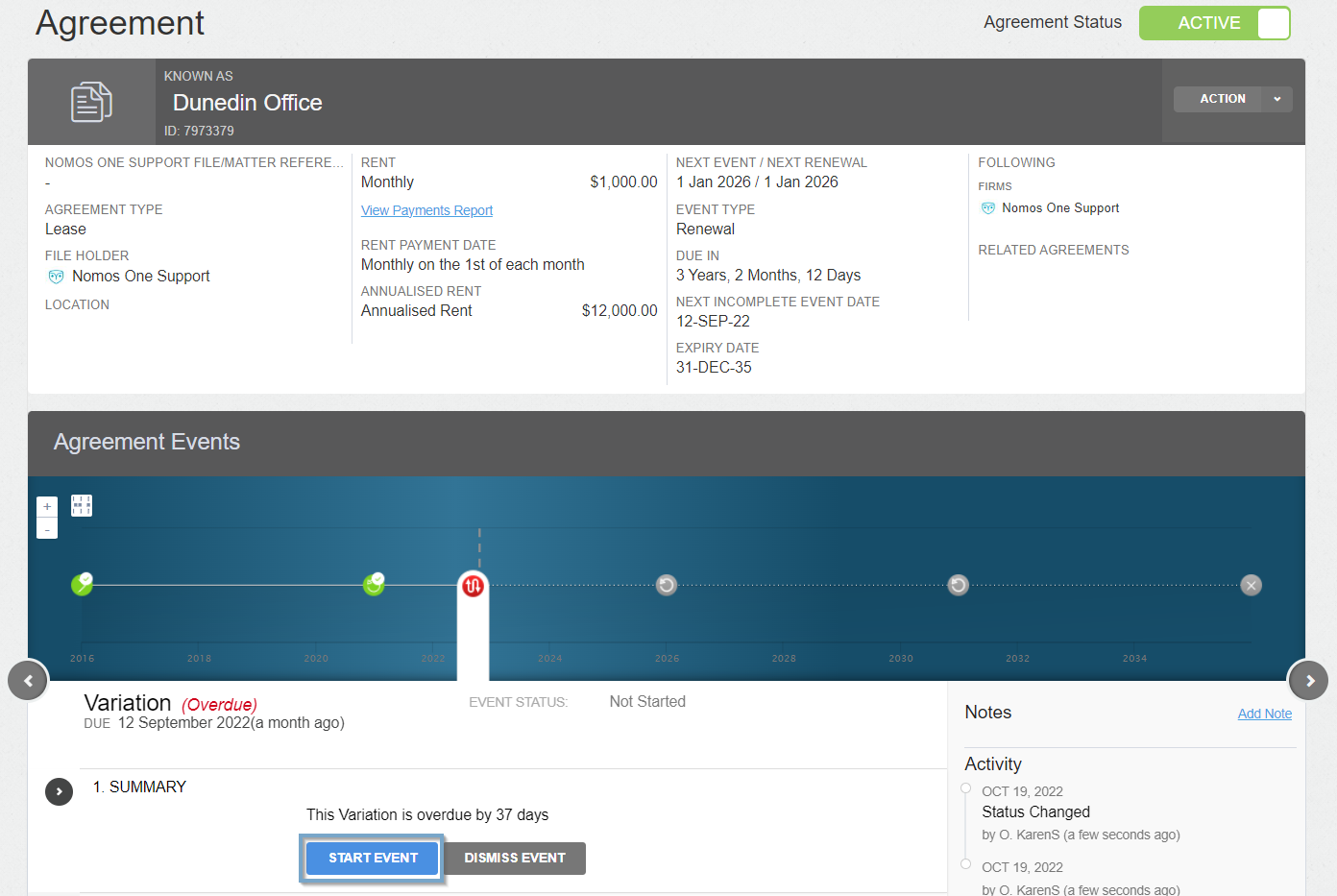

- You'll now see a Variation icon on the Agreement Timeline. At Step 1 on this Event, click Start Event

While you can add Events on a date that is within a locked period, you cannot complete these Events on the Agreement Event Timeline. If your Variation Event is within a locked period, you'll need to ask a user with the Administrator permission in your Organisation to edit the Lock Date before you can complete the Event. Check out this article for more information.

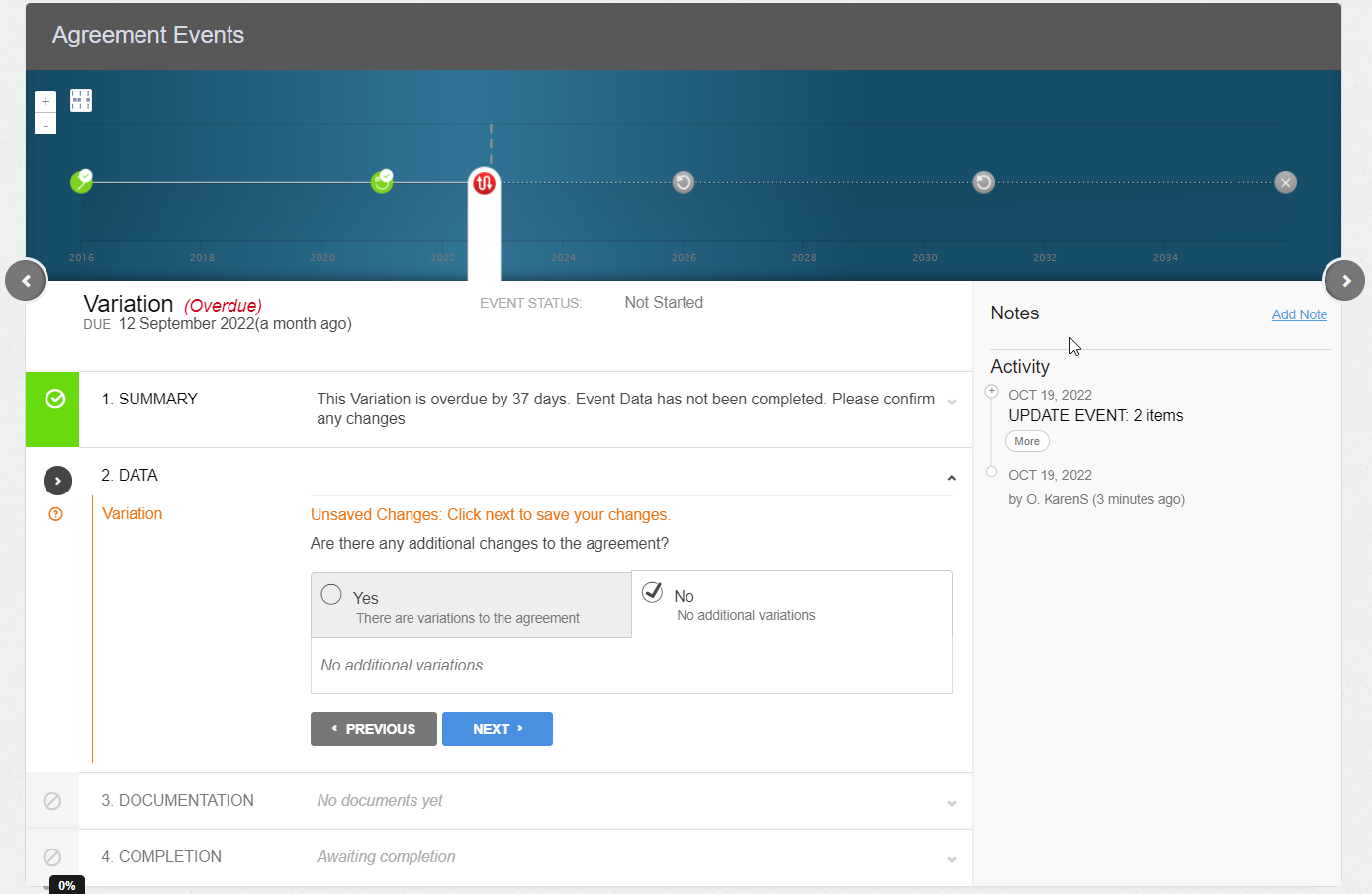

- At the Data Step, unless there are other changes from the Variation date, select No additional Variations, then click Next

Please note: Not every part of your Agreement can be updated in a Variation Event. Check out this list here to see what can and can't be changed.

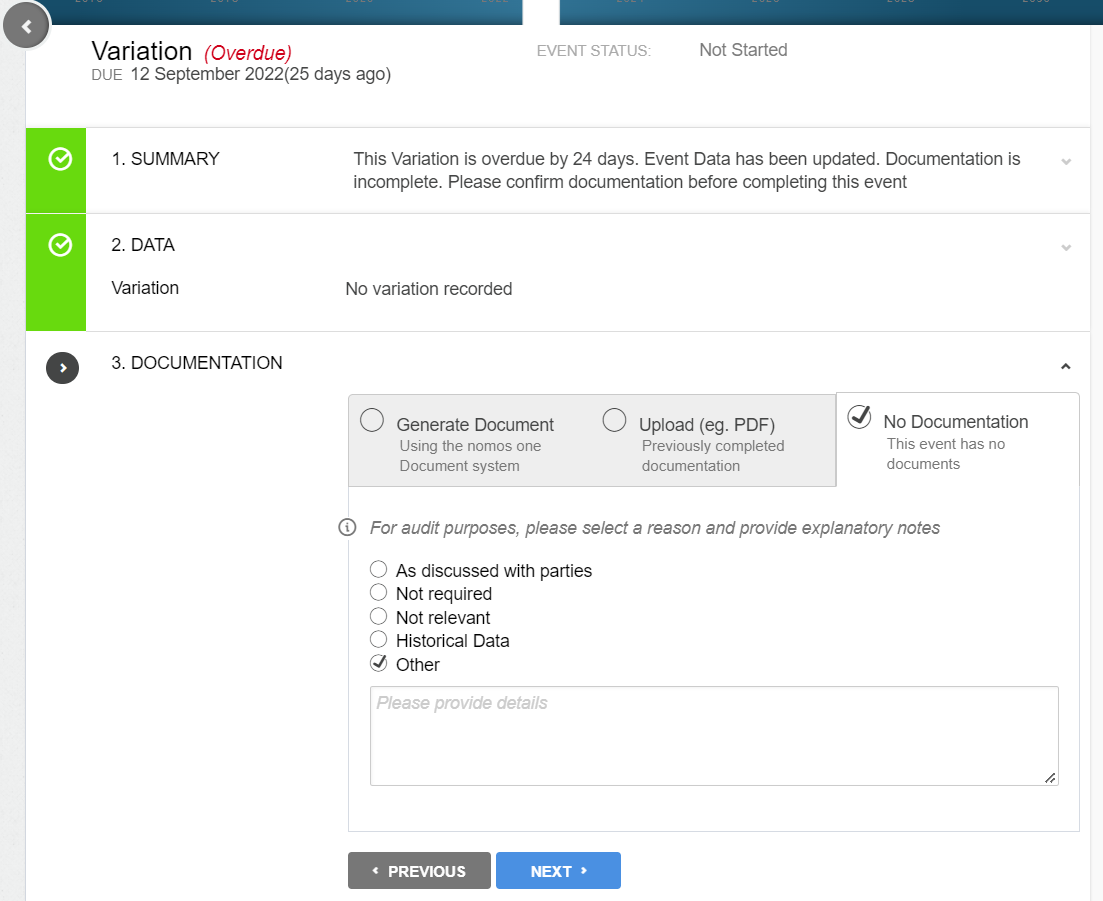

- Upload any supporting documentation at Step 3, or select No Documentation then click Next

- Check that the Data Change Date matches the Variation Event date and click Complete. If these don't match, click Edit and use the calendar tool to update this. You can then click on Complete and you're Done!

- Once the Event has been completed, at Step 5, select Yes Settings should change to reveal the IFRS Settings Change Questionnaire

As the IFRS 16 Settings Change Questionnaire is always tied to an Event, you won't be able to add or edit the IFRS 16 Settings Change Questionnaire on an Event that is within a locked period. You'll need to ask a user with the Administrator permission in your Organisation to edit the Lock Date. Check out this article for more information.

- Scroll down to the Variation and Modification Accounting section then toggle the "Non-contractual change in rent? (e.g. change in rent outside a rent review)" to Yes, and record the new Interest Rate in the text field

- Click Save at the bottom of the Questionnaire. You'll see a pop-up message saying that the Setting saved

Validating the change in your Interest Rate

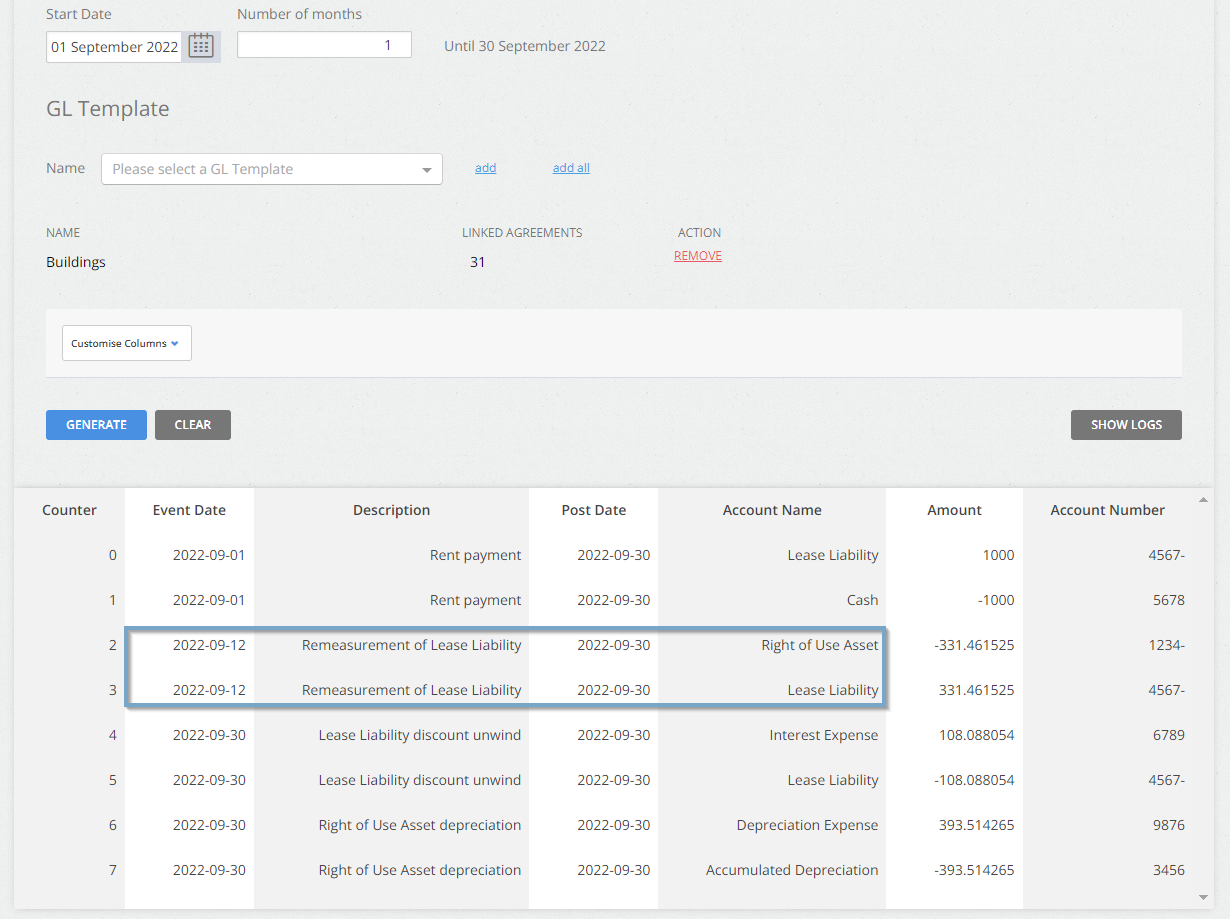

You can validate if the change to your Interest Rate was successfully recorded by running your Journals across the Effective Date of your Variation Event and seeing a Remeasurement in Lease Liability entry.

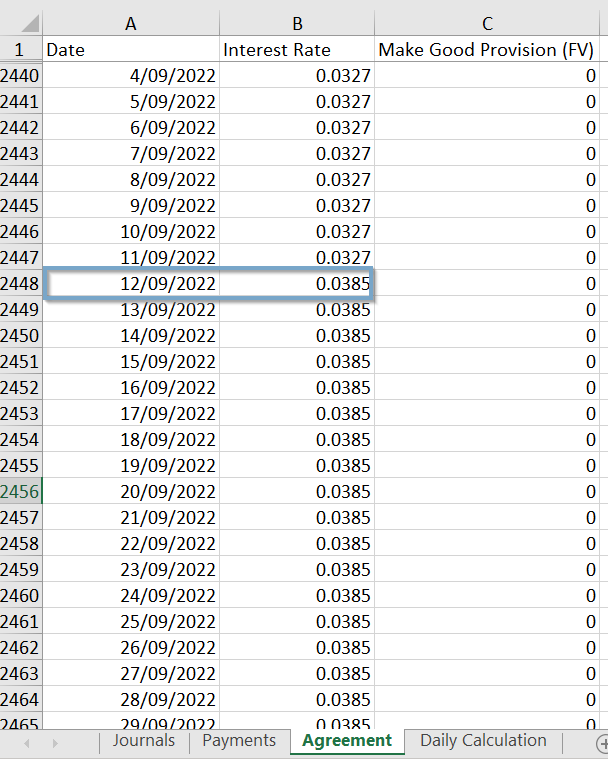

Another way of validating the change in the Interest Rate is to download the Daily Calculation Report. In the Agreement tab, you can filter or search for the Effective Date of the Change and you’ll see the updated Interest Rate applied from that date forward.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.