This article will explain the IFRS Component Payments and Non IFRS Component Payments available on the Rent & Payment page of an Agreement.

IFRS Component Payments

Any IFRS Component Payments recorded for an Agreement will appear in the IFRS 16 Reports for that Agreement. Certain payments will directly impact IFRS 16 balances, and others will simply be included in the reports for reference.

Do you need to add or alter an IFRS Component Payment with an effective date within a locked period? You will be unable to add or alter the payment until the period is unlocked. A user with the Administrator permission in your Organisation will need to edit the Lock Date before you can add, edit, or remove any applicable IFRS Component payments. Check out this article for more information.

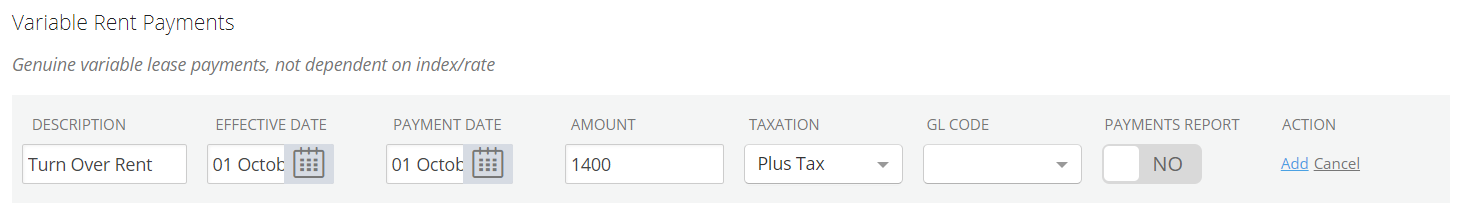

Variable Rent Payments

The Variable Rent Payment function allows you to record any rent payments that are based on an external factor that means your rent is always changing, e.g., rent based on turnover from a preceding period.

As the nature of these payments is variable, they're not included in IFRS 16 calculations, as there is no way to predict the value of Lease Liability or Right of Use Asset. You will, however, see reference to these payments as an expense entry when you run the Journal Report.

To record:

- Enter a description.

- Enter the date you make the payment into the Effective Date and Payment Date fields.

- Enter the amount.

- Record the taxation treatment of the amount. This detail will only appear in the Payments by Period report; the amount in the IFRS 16 reports will simply be what is recorded in the Amount field.

- Skip the GL Code and Payments Report field - these are legacy features.

- Click “Add”.

Holiday/Discounts

The Holiday/Discount function allows you to record specified time periods wherein rent is reduced, either partially or entirely. As these "payments" reduce the total rent owed, they will reduce the Lease Liability for the Agreement.

You can add in multiple holidays/discounts as they apply to your Agreement. If there is a period of time when two or more rent holidays/discounts apply in a single Agreement, please contact our Support Team so we can help reflect this in the system.

To record:

- Enter a description.

- Enter the effective date of the payment. This is the date on which you'll see the resulting remeasurement of the Lease Liability and/or Right of Use Asset.

- Choose whether the discount is permanent, or over a specified date range.

- If permanent, record the start date.

- If over a date range, record the start date and the end date.

- Choose the amount type, either percentage or dollar.

- Enter the amount.

- If percentage, enter the amount that the payment is discounted by.

- If dollar, enter the amount that gets deducted from every rent payment during the specified period.

- Skip the GL Code and Exclude field - these are legacy features.

- Click “Add”.

Please note: The “amount type” you choose will impact how the discount applies to the rent payments.

- Percentage (%): the system will deduct the recorded percentage across the specified period. For any proportionate periods, the holiday/discount may result in a pro-rata payment amount.

- Dollar ($): the system will deduct the recorded amount from each payment that occurs during the specified period (i.e., between the Start Date and End Date). For example, a discount that runs for 6 months, recorded as a discount of $500, on an Agreement set up to pay rent monthly, will deduct $500 from every rent payment during the specified period.

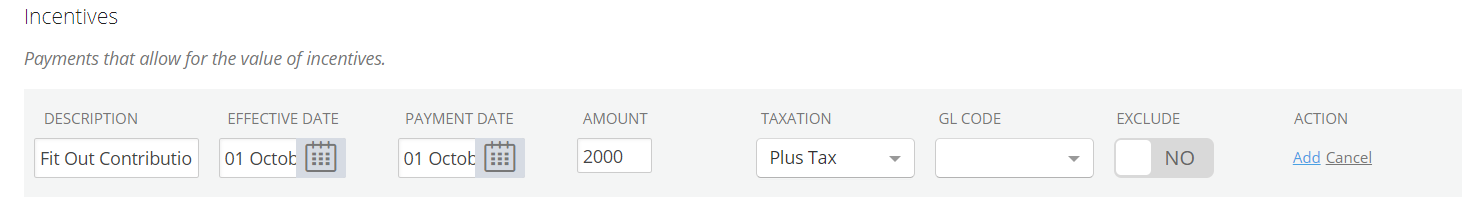

Incentives

The Incentive function allows you to record any incentives relevant to the Agreement. Nomos One defines “incentives” as positive payments from the Lessor to the Lessee. Examples include contributions toward fit out costs or moving costs.

If the incentive is paid prior to the contractual commencement date, the payment will impact the Right of Use Asset for the Agreement. If the incentive is paid on or after the contractual commencement date, the payment will impact the Lease Liability for the Agreement.

To record:

- Enter a description.

- Enter the effective date of the payment. This is the date on which you'll see the resulting remeasurement of the Lease Liability and/or Right of Use Asset.

- Enter the date the payment is made.

- Enter the amount.

- Record the taxation treatment of the amount. This detail will only appear in the Payments by Period report; the amount in the IFRS 16 reports will simply be what is recorded in the Amount field.

- Skip the GL Code and Exclude field - these are legacy features.

- Click “Add”.

If you have an "incentive" that reduces the rent amount for a specified time period, you should record it using the Holiday/Discounts function.

To understand more about how Incentives are reflected in your IFRS 16 reports, check out this article.

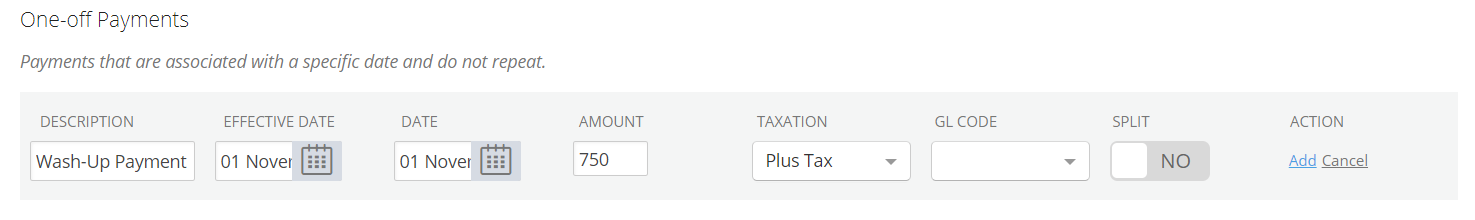

One-Off Payments

The One-Off Payment function allows you to record one-time payments made from the Lessee to the Lessor. Recording a One-Off Payment will contribute to the Agreement's Lease Liability.

To record:

- Enter a description.

- Enter the effective date of the payment. This is the date on which you'll see the resulting remeasurement of the Lease Liability and/or Right of Use Asset.

- Enter the date the payment is made.

- Enter the amount.

- Record the taxation treatment of the amount. This detail will only appear in the Payments by Period report; the amount in the IFRS 16 reports will simply be what is recorded in the Amount field.

- Skip the GL Code and Split field - these are legacy features.

- Click “Add”.

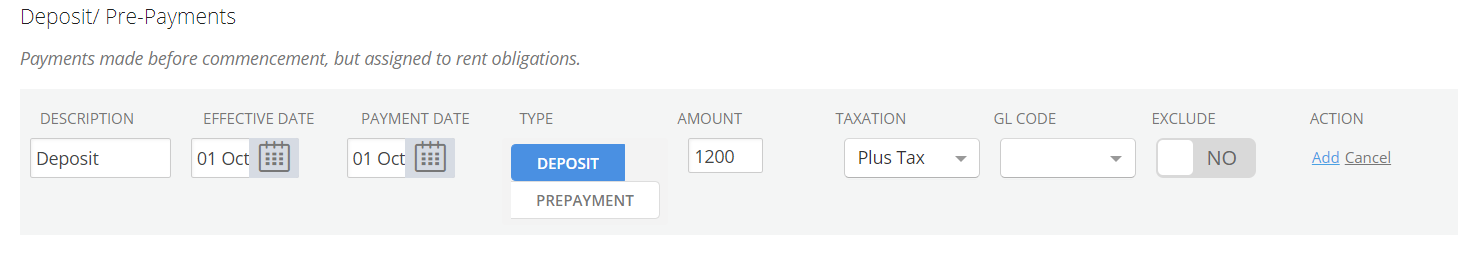

Deposit and Pre-payments

Deposits and Pre-Payments are recorded using the same payment function. After clicking “add deposit/pre-payment”, use the Type field to choose whether you need to record a deposit or a pre-payment.

Deposits

The Deposit function allows you to record security deposits or bonds that the Lessee pays to the Lessor. As these payments are held as a bond and don't contribute to rent, they don't impact IFRS 16 calculations. You will still see reference to the deposit at the start and end of the Agreement's journals.

- Enter a description.

- Enter the date you make the payment into the Effective Date and Payment Date fields.

- Select “Deposit” in the Type field.

- Enter the amount.

- Record the taxation treatment of the amount. This detail will only appear in the Payments by Period report; the amount in the IFRS 16 reports will simply be what is recorded in the Amount field.

- Skip the GL Code and Exclude field - these are legacy features.

- Click “Add”.

Pre-Payments

The Pre-Payment function allows you to record lump sum payments that are made before the first rent payment date of the Agreement, contributing toward the rent amount owed during the specified period. Pre-Payments will reduce the Lease Liability value. Depending on the recorded effective date and the transition method chosen for this Agreement, there may be an adjustment to the Agreement's Right of Use Asset value.

- Enter a description.

- Enter the effective date of the payment. This is the date on which you'll see the resulting remeasurement of the Lease Liability and/or Right of Use Asset.

- Enter the date the payment is made.

- Select “Prepayment” in the Type field.

- Enter the amount. The amount recorded will be deducted from each regular rent payment set to occur between the start and end dates recorded.

- Enter the date range that the lump sum payment covers.

- Record the taxation treatment of the amount. This detail will only appear in the Payments by Period report; the amount in the IFRS 16 reports will simply be what is recorded in the Amount field.

- Skip the GL Code and Exclude field - these are legacy features.

- Click “Add”.

We're currently experiencing an issue wherein Pre-Payments apply from the Commencement Date of your Agreement, regardless of the Effective Date or Payment Date entered. We have determined that the appropriate workaround for this issue is to:

- Record a One-Off Payment for the amount you prepaid.

- Record a Rent Holiday for the time period covered by the Pre-Payment.

Using this workaround will account for the lump sum payment and reduce the regular rent payments that occur during the recorded time period. If you have any questions about using this workaround, please reach out to our Support Team at support@nomosone.com.

Non IFRS Components

Any Non IFRS Component Payments recorded for an Agreement will appear in the Contractual Reports for that Agreement. These payments will have no impact on the IFRS 16 Reports.

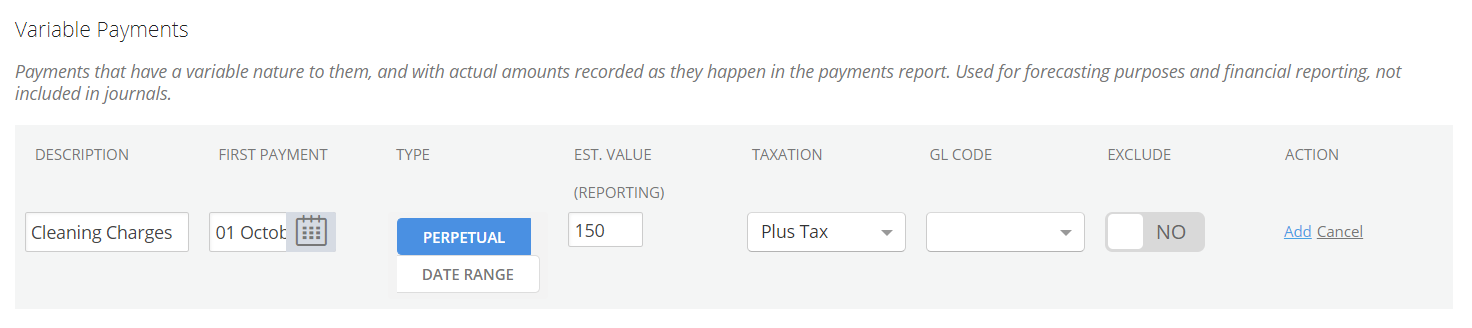

Variable Payments

The Variable Payment function allows you to record any non-rent payments that are based on an external factor that means the amount is always changing.

To record:

- Enter a description.

- Choose whether the variable payments are perpetual, or over a specified date range.

- If perpetual, record the date the first payment is made.

- If over a date range, record the start date and the end date.

- Enter the estimated amount of the payment. The actual amount can be recorded in the Payments by Period Report.

- Record the taxation treatment of the amount.

- Skip the GL Code and Exclude field - these are legacy features.

- Click “Add”.

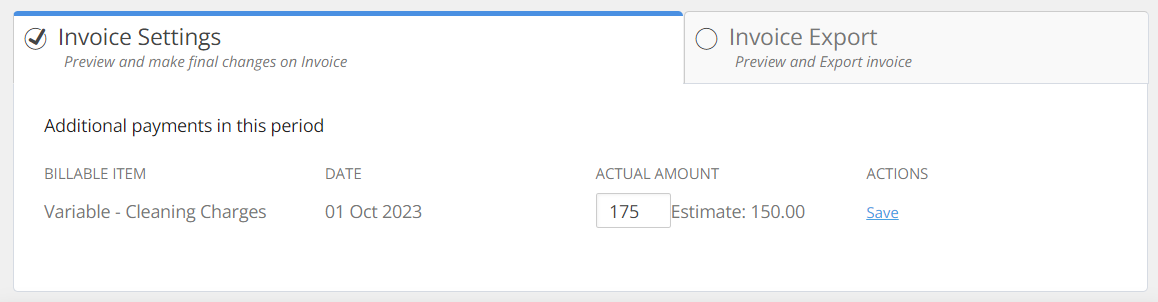

As mentioned, when you add in a Variable Rent Payment, you will record the estimated value of the payment. Once the actual value becomes known, you can record the amount in the Payments by Period Report.

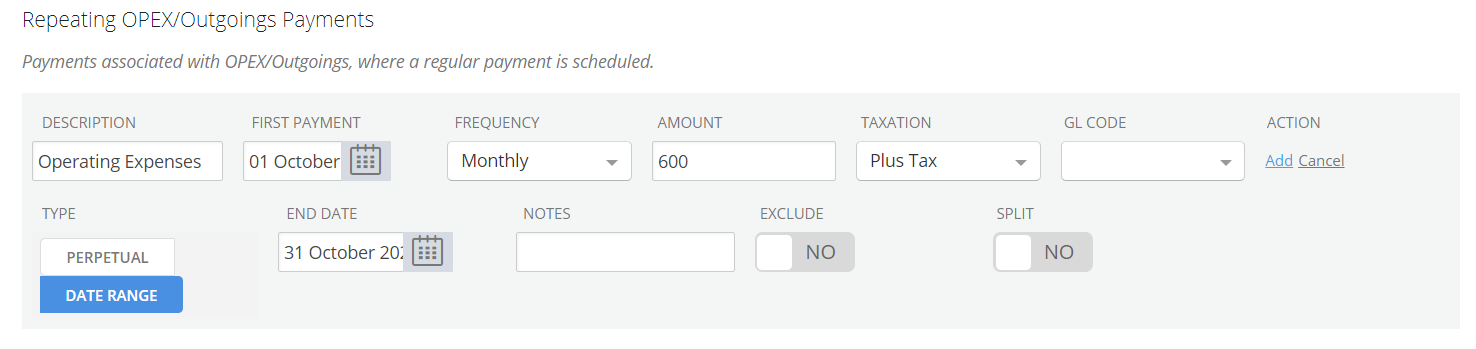

Repeating OPEX/Outgoings Payments

The Repeating OPEX/Outgoings Payment function allows you to record any payments associated with operating expenses, like electricity or internet.

To record:

- Enter a description.

- Choose whether the OPEX/outgoings payments are perpetual, or over a specified date range.

- If permanent, record the date the first payment is made.

- If over a date range, record the first payment date and the end date.

- Choose the payment frequency, i.e., whether the amount is paid weekly, monthly, annually, etc.

- Enter the amount of the payment.

- Record the taxation treatment of the amount.

- Skip the GL Code, Notes, Exclude, and Split field - these are legacy features.

- Click “Add”.

You can use this function to record a one-off OPEX/outgoings payment. This will record a single payment on the recorded First Payment date. To do so:

- Select “monthly” for the Frequency field.

- Select “date range” for the Type field.

- Record the date of the one-time payment in the First Payment field.

- Record the late date of the month that you made the payment in the End Date field.

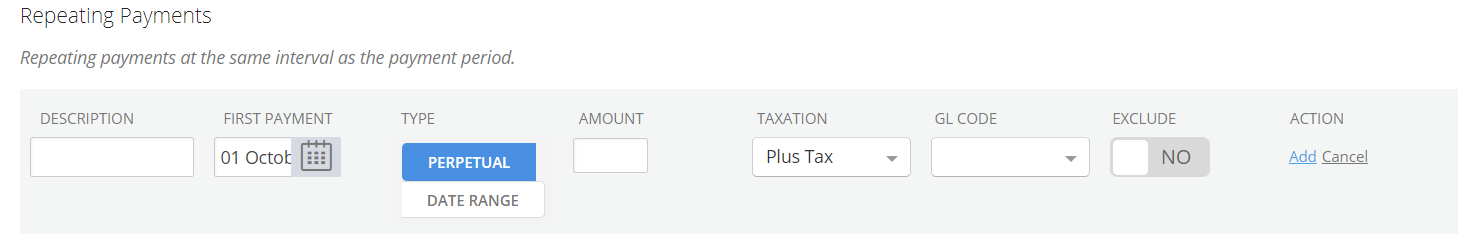

Repeating Payments

The Repeating Payments function allows you to record any repeating payments that you don't want to classify as operating expenses or outgoings. These will occur based on the same frequency as the regular rent payment, as recorded in the Payment Period field at the top of the Rent & Payment page.

- Enter a description.

- Choose whether the repeating payments are perpetual, or over a specified date range.

- If permanent, record the date the first payment is made.

- If over a date range, record the first payment date and the end date.

- Enter the amount of the payment.

- Record the taxation treatment of the amount.

- Skip the GL Code and Exclude field - these are legacy features.

- Click “Add”.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.