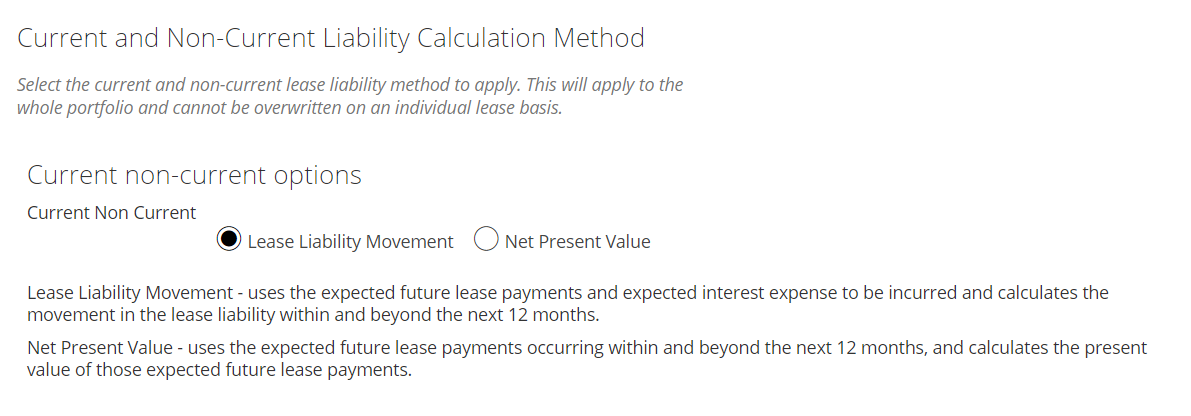

For disclosure requirements, there are two different methodologies that are available to companies when reporting on the Current and Non-Current Lease Liability balances. In this article, we'll detail these two methodologies - which are available in Nomos One - and explain how each method calculates the current and non-current lease liability sections of the Disclosure Report and the Agreement Balances Report.

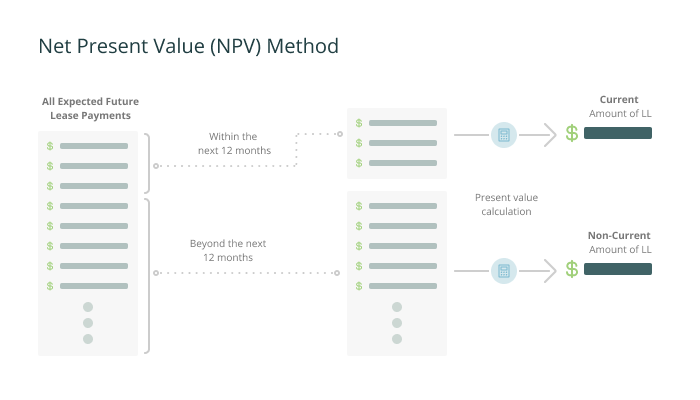

Net Present Value

The Net Present Value methodology uses the expected future lease payments occurring within and beyond the next 12 months, and then calculates the present value of those expected future lease payments. This is the default methodology that Nomos One applies to an Organisation, and is in line with how the overall Lease Liability is calculated.

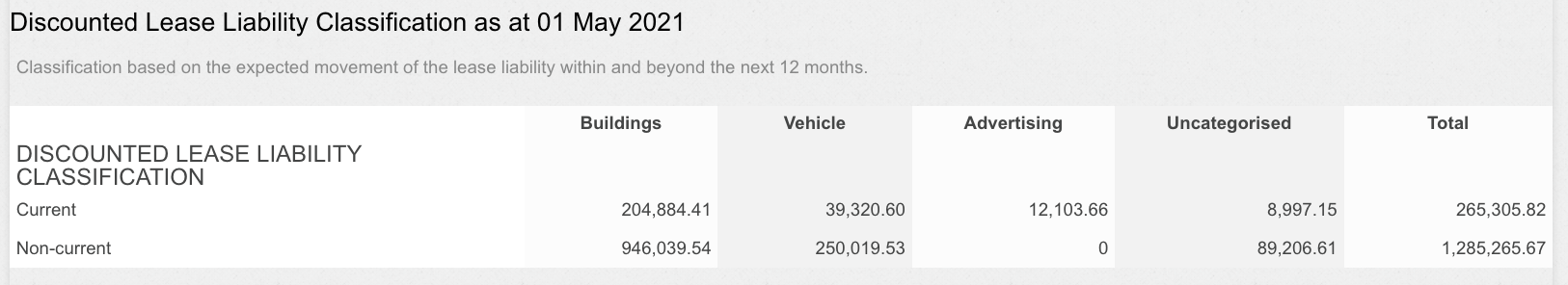

Current amount = present value of the lease payments expected within the next 12 months.

Non-current amount = present value of the lease payments expected beyond the next 12 months.

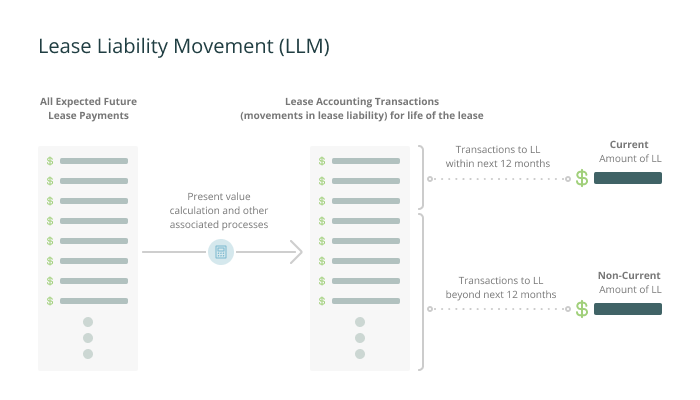

Lease Liability Movement

The Lease Liability Movement methodology uses the expected future lease payments and expected interest expense to be incurred to calculate the movement in the Lease Liability within and beyond the next 12 months. This methodology reflects the movement in the Lease Liability over the life of the lease.

Current amount = future value of the expected lease payments, less incurred interest expense, within the next 12 months. This is also the amount by which the Lease Liability is expected to reduce/move by in the next 12 months.

Non-current amount = future value of the expected lease payments, less incurred interest expense, beyond the next 12 months. This is also the amount by which the Lease Liability is expected to reduce/move beyond the next 12 months.

Changing your Current/Non-Current reporting method

Changing between the two methods will show differences in your current/non-current values, based on the fundamental differences between the calculation methods. The method chosen will apply to all Agreements within an Organisation, and cannot be split across different Agreements, asset classes, or entities.

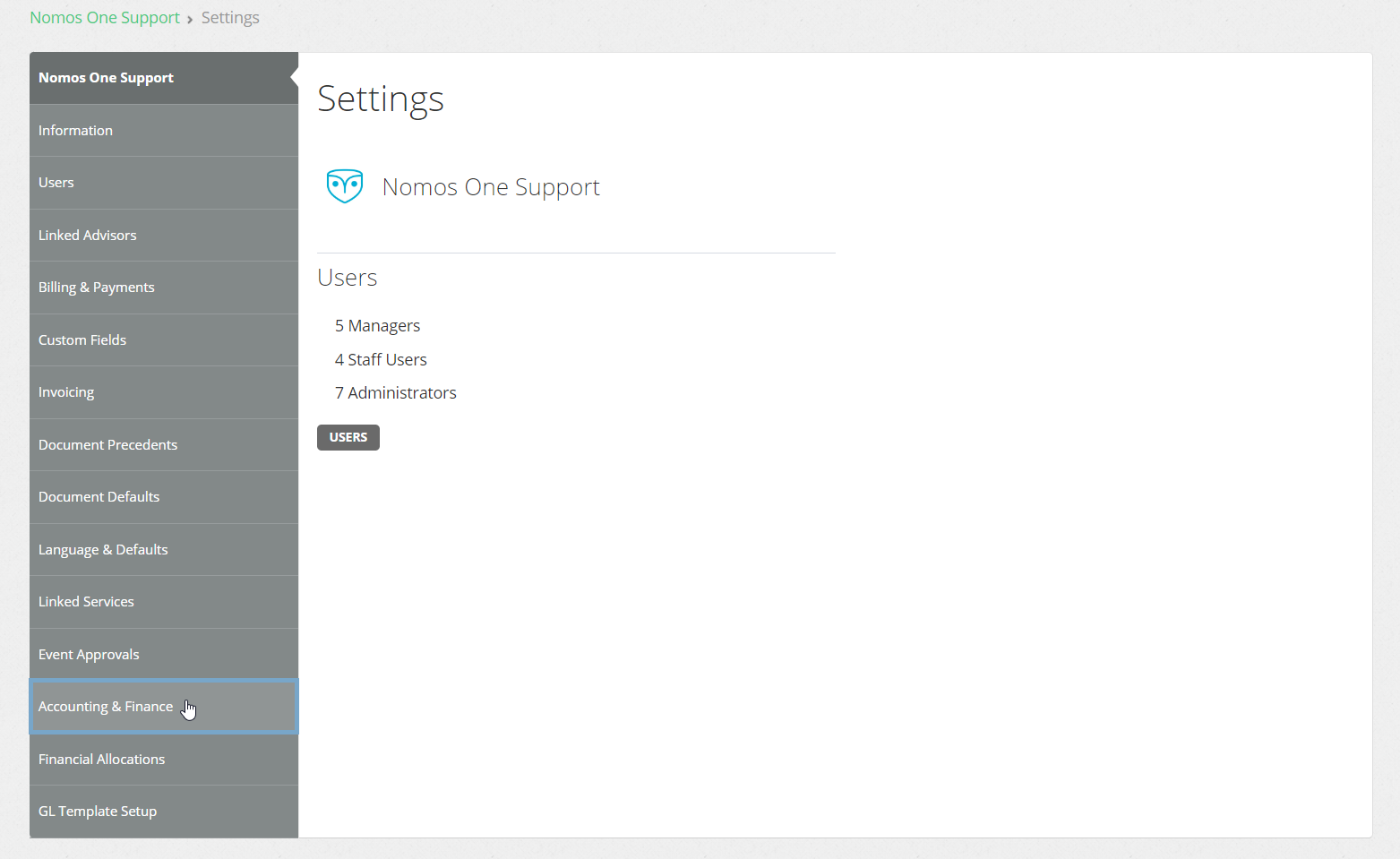

Please Note: Only users with the Admin permission can change the Reporting method in the Settings console.

Additionally, after changing your chosen calculation method, it is sometimes necessary to wait around 5 minutes before running reports, to ensure that the changes have been fully processed. If you have made the change, but are not seeing it reflected in reports after more than 5-10 minutes, please reach out to our Support Team at support@nomosone.com.

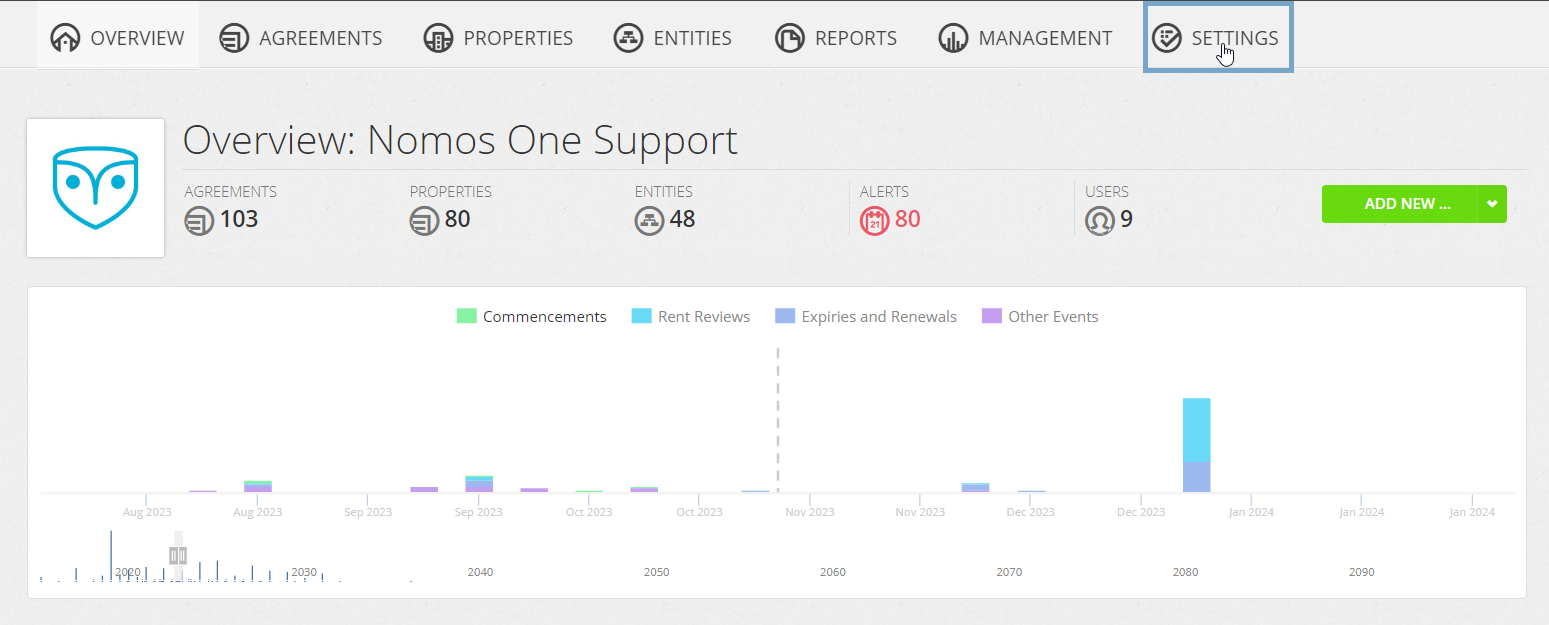

To change your Current/Non-current reporting method:

- Navigate to the Settings Console.

- Click on the “Accounting & Finance” tab.

- Scroll to the section titled “Current and Non-Current Liability Calculation Method”.

- To change from using the Net Present Value method, select “Lease Liability Movement”. To change from using the Lease Liability Movement method, select “Net Present Value”.

- Generate a Disclosure Report or Agreement Balances Report to view the impact of the change you've made.

Please note: The reporting method you select will apply to all Agreements in your organisation. It cannot be set up for only some Agreements. You can switch between the two methods as frequently as you need.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.