If you haven't already, go ahead and read this article first to understand the different options for recording a Holdover or Month to Month Agreement in Nomos One.

If you've reviewed our article on creating Holdover and Month to Month Agreements in Nomos One and decided to go with Option Two, this article will walk you through those steps. If you're looking for the steps for Option One, you can find them here.

How to Create a New Agreement to Reflect your Holdover or Month to Month Setup

To create a new Agreement to reflect this setup:

- Determine the anticipated Holdover or Month to Month period(s) your Organisation is reasonably certain to exercise. For reporting under IFRS 16, there has to be a known Expiry date so this is a must

For example: Your existing Agreement is set to expire on 31 July 2023. Your Organisation has just found out this it will move into Holdover state but it is unclear when the new Agreement will be signed, so the period of Holdover is unclear.

Your team needs to collectively make a decision as to when you reasonably expect a new lease/renewal to begin, and the Holdover period to end. If the Holdover period does last longer or finish earlier, no fret, you can extend or reduce the lease term whenever you need to reflect changes to this assumption at any time.

- Navigate to the Agreement that is moving into Holdover or a Month to Month setup

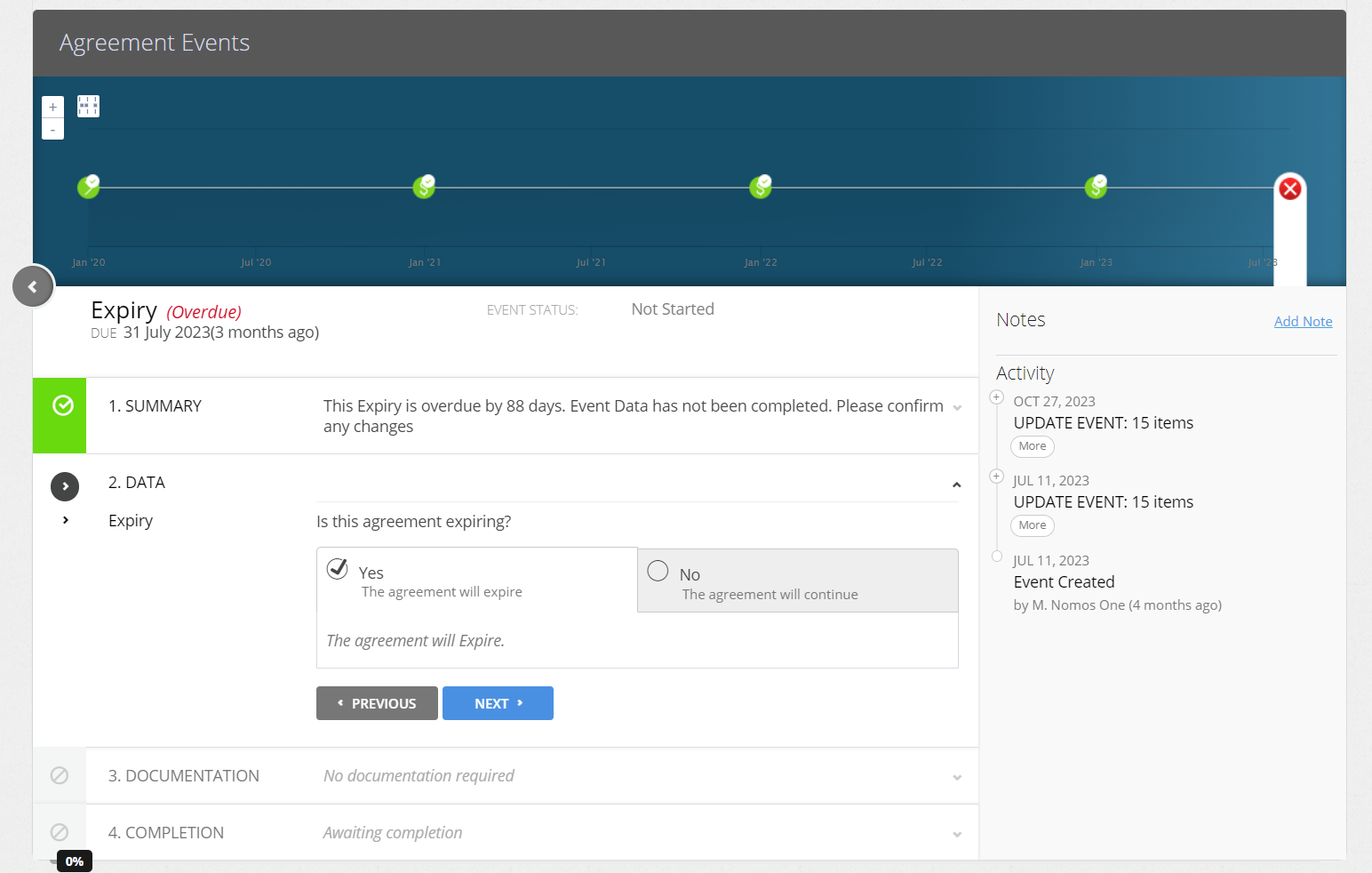

- Complete the Expiry Event or Renewal Event (as Step 2 set the Agreement to 'Expire') to expire the current Agreement

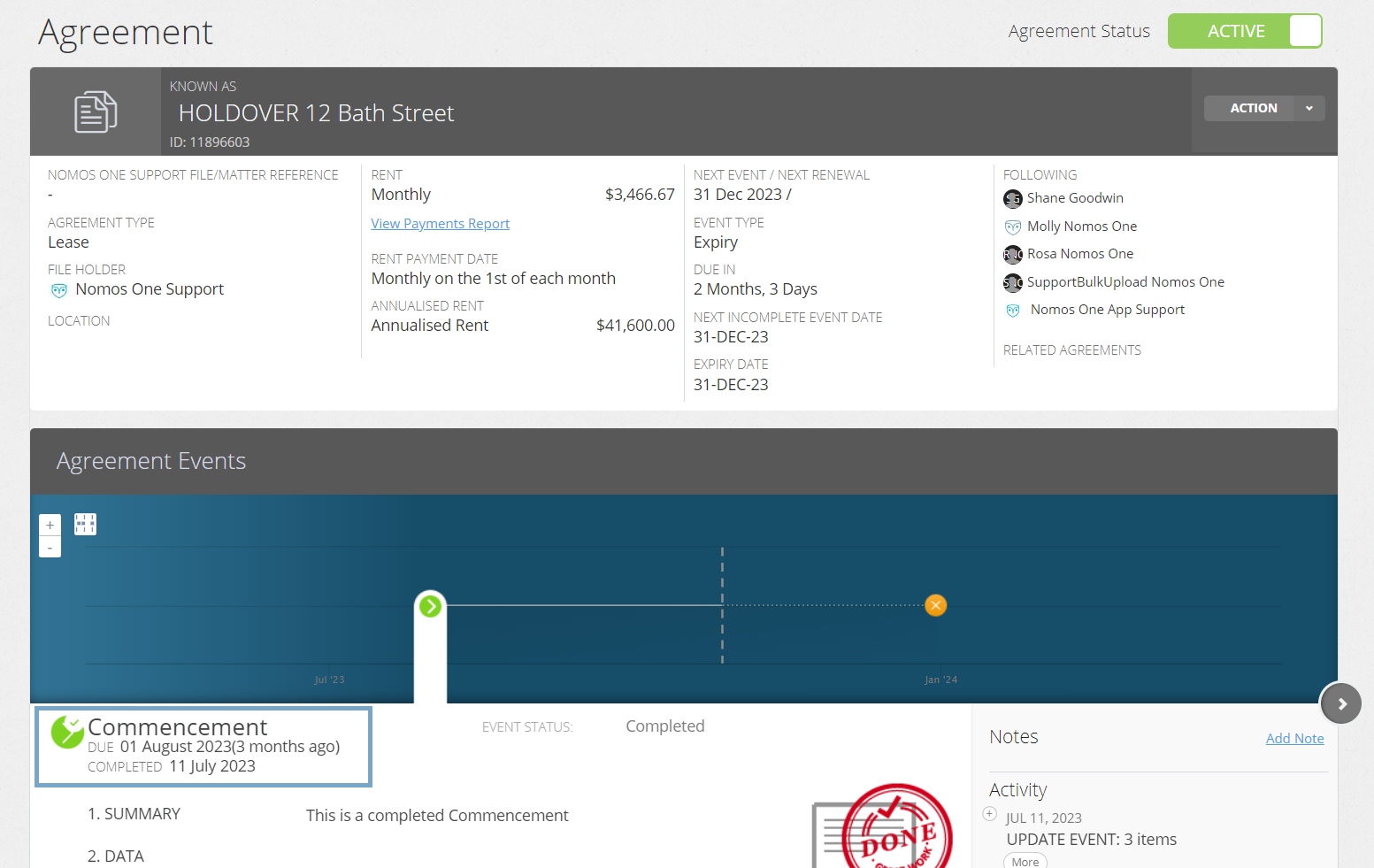

- Create a new version of the Agreement reflecting the Holdover or Month to Month conditions

- The Commencement Date of the new Agreement should be the start date or the Holdover or Month to Month period, and the term length should be the anticipated Holdover or Month to Month period.

- Record any Rent payable together with any other pertinent information you want to capture in your reporting for this Agreement.

- Complete the Commencement Event on the Timeline then make the Agreement Active.

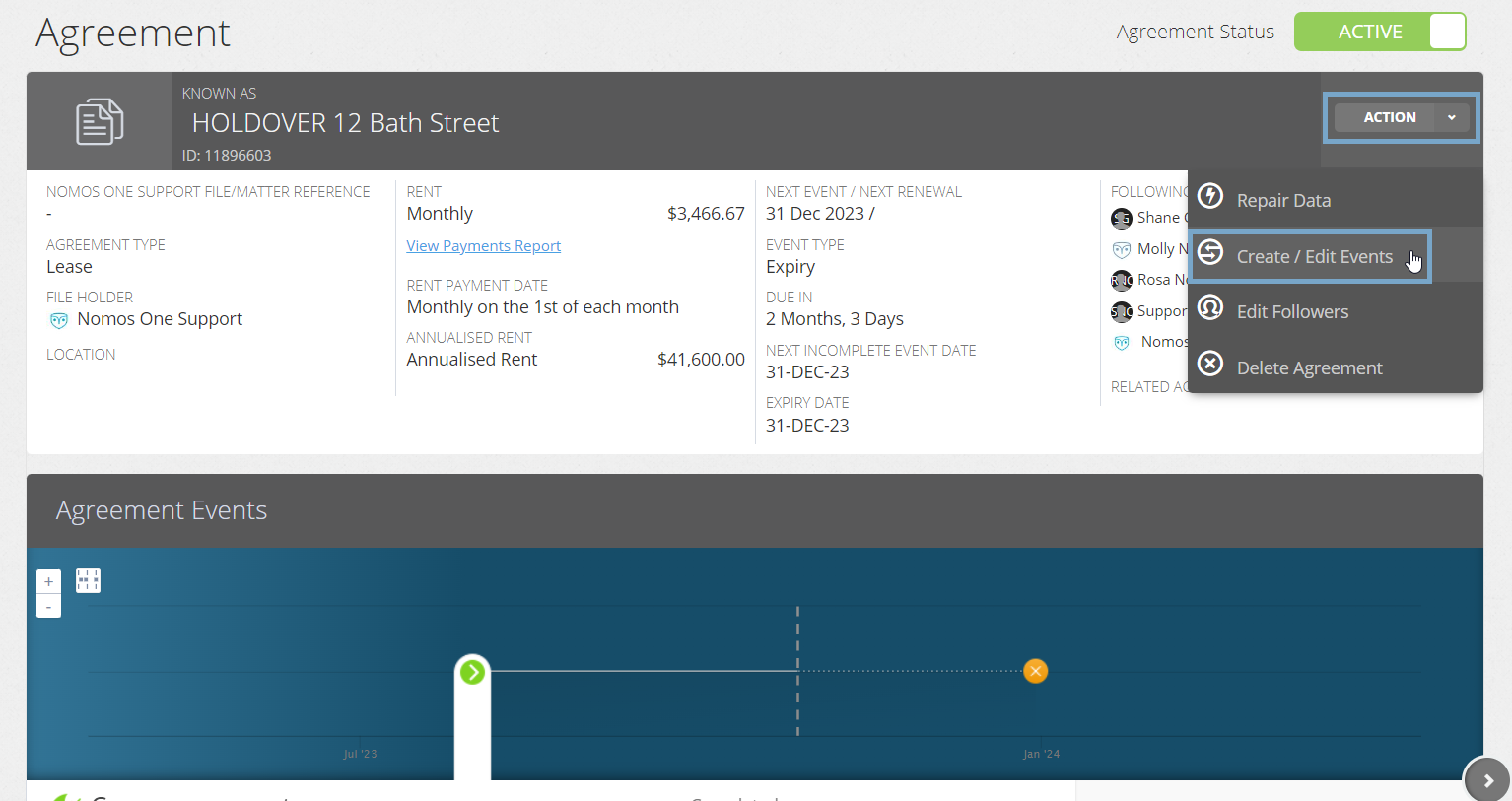

- Then click Action > Repair Data

- On the Settings page, in the IFRS 16 Initial Questionnaire, toggle the bar 'Does the Agreement meet the definition of a lease as defined in IFRS 16' from No to Yes

- Toggle the bar 'Does this Agreement fall within one of the scope exemptions within IFRS 16' from No to Yes and select one of the Exemption Reasons

Making your Agreement Exempt will stop any calculation of the Right of Use Asset and Lease Liability, but you'll see associated exempt entries in your Reports for the Agreement.

- Scroll down to the bottom of the Agreement and click Done to save the changes made

Your Holdover or Month to Month setup is now ready to go!

You'll see the original version of your Agreement expire at the date you triggered it to, and the holdover Agreement produce Exempt Agreement entries on your Report from the Commencement of your Holdover period.

What Next?

When your Agreement term(s) are finalised and you're moving out of the Holdover or Month to Month arrangement, you can update the Expiry Date of your Agreement using one of two methods:

- If the anticipated Holdover or Month to Month period has expired in accordance with the dates originally entered, you can simply Complete the Expiry Event on this Agreement; or

- If the lease term ended up being different to the estimated expiry, you can update the Expiry date by extending or decreasing the lease term to match the up to date assumed or confirmed Expiry date for this arrangement

If at any time the anticipated Expiry date changes from what you initially assumed or the new Agreement's term(s) are finalised, you can use the second method above to either extend or decrease the lease term expiry to match your new assumptions.

If you're out of the Holdover or Month to Month period and have negotiated a new Agreement, you can create your new Agreement to reflect the newly agreed terms.

If you follow this method you should end up with three Agreements concerning your property or asset under lease. If you'd like to link these in some way, you can use the Related Agreements function to create a handy hyperlink between them for ease of navigation.

Nomos One does not provide or purport to provide any accounting, financial, tax, legal or any professional advice, nor does Nomos One purport to offer a financial product or service. Nomos One is not responsible or liable for any claim, loss, damage, costs or expenses resulting from your use of or reliance on these resource materials. It is your responsibility to obtain accounting, financial, legal and taxation advice to ensure your use of the Nomos One system meets your individual requirements.